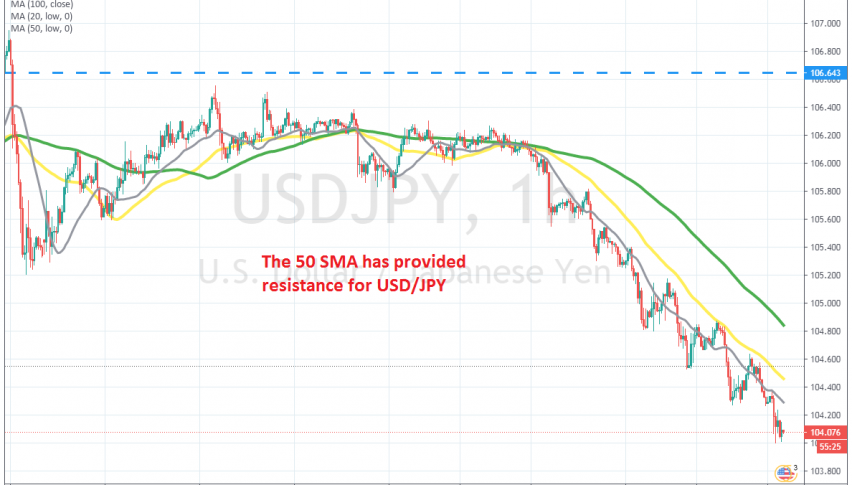

USD/JPY dived more than 10 cents lower on the coronavirus panic during late February and early March. But, it reversed up quite fast and made up for the losses in the following weeks. Although, since April the pressure has been on the downside for this pair.

Moving averages have been doing a good job during this time, with the 100 SMA providing resistance for USD/JPY since late June, keeping buyers in check. The uncertainty has kept safe havens such as Gold and the JPY well bid in the past months, while the USD weakens has also been helping sellers here.

During early September we saw some consolidation in this pair, but the bearish trend resumed last week. USD/JPY has declined more than 200 pips since last Monday and moving averages are keeping the pressure on. The 50 SMA (yellow) has been providing resistance during small pullbacks, so we will try to sell pullbacks at that moving average. Although, we will be cautious, because the decline has been too fast and we might see a decent pullback higher before the next leg lower.