⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

Buying USD/CAD After the Great US ISM Manufacturing Report

As we mentioned in our Eurozone manufacturing update earlier today, this sector is booming everywhere during this second round of coronavirus restrictions unlike in the first round at the end of last year when it dived in recession.

Eurozone manufacturing activity remains high, but in the US the situation is even better, as the comments in the statement show. We decided to buy USD/CAD after that report, since this pair has retreated enough on the H1 chart and the 50 SMA is providing support on the H1 chart, as shown above.

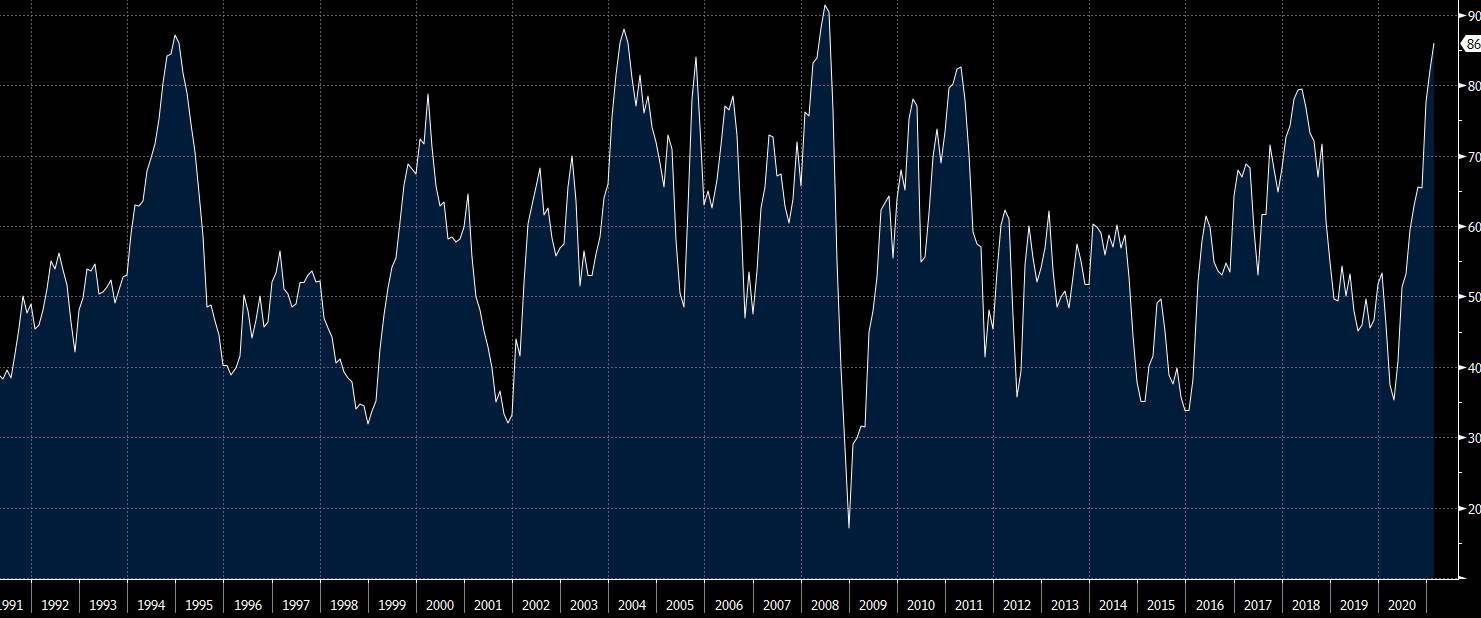

ISM Manufacturing Index February 2021

- ISM manufacturing 60.8 points vs 58.6 expected

- January was 58.7 points

- Prices paid 86.0 points vs 82.1 in January (highest since 2008)

- New orders 64.8 points vs 61.1 in January

- Employment 54.4 points vs 52.6 in January

This is a great report but the continuing rise in prices is worrisome.

Comments in the report:

- “The coronavirus [COVID-19] pandemic is affecting us in terms of getting material to build from local and our overseas third- and fourth-tier suppliers. Suppliers are complaining of [a lack of] available resources [people] for manufacturing, creating major delivery issues.” (Computer & Electronic Products)

- “Supply chains are depleted; inventories up and down the supply chain are empty. Lead times increasing, prices increasing, [and] demand increasing. Deep freeze in the Gulf Coast expected to extend duration of shortages.” (Chemical Products)

- “Steel prices have increased significantly in recent months, driving costs up from our suppliers and on proposals for new work that we are bidding. In addition, the tariffs and anti-dumping fees/penalties incurred by international mills/suppliers are being passed on to us.” (Transportation Equipment)

- “We have experienced a higher rate of delinquent shipments from our ingredient suppliers in the last month. We are still struggling keeping our production lines fully manned. We anticipate a fast and large order surge in the food-service sector as restaurants open back up.” (Food, Beverage & Tobacco Products)

- “Overall capacities are full across our industry. Logistics times are at record times. Continuing to fight through shipping and increased lead times on both raw materials and finished goods due to the pandemic.” (Fabricated Metal Products)

- “Prices are going up, and lead times are growing longer by the day. While business and backlog remain strong, the supply chain is going to be stretched very [thin] to keep up.” (Machinery)

- “Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.” (Electrical Equipment, Appliances & Components)

- “Labor shortages at suppliers are affecting material deliveries and prices.” (Plastics & Rubber Products)

- “We have seen our new-order log increase by 40 percent over the last two months. We are overloaded with orders and do not have the personnel to get product out the door on schedule.” (Primary Metals)

- “A sense of urgency is being felt regarding new orders. Customers are giving an impression that a presence of stability is forthcoming and order flow is increasing.” (Textile Mills)

- “Prices are rising so rapidly that many are wondering if [the situation] is sustainable. Shortages have the industry concerned for supply going forward, at least deep into the second quarter.” (Wood Products)

These comments are even more bullish than then numbers themselves.

Prices Paid Chart

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments