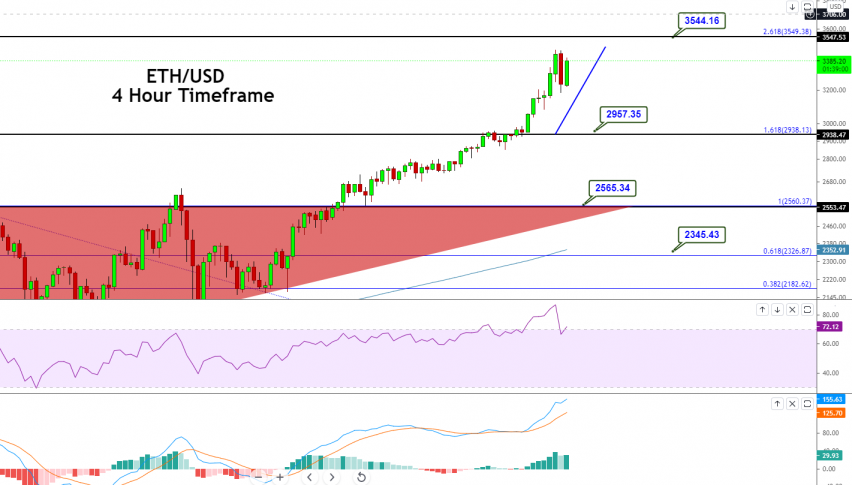

Ethereum Price Forecast – Bullish Bias Continues to Dominate, Brace for Buying!

ETH/USD closed at $3427.54 after placing a high of $3427.54 and a low of $2952.01. ETH extended its gains and rose for the ninth consecutive

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

ETH/USD closed at $3427.54 after placing a high of $3427.54 and a low of $2952.01. ETH/USD extended its gains and rose for the ninth consecutive session on Monday and reached a new all-time high (ATH) at the $3427 level. Ethereum, the second-largest cryptocurrency by market cap and biggest rival to Bitcoin, surpassed the key $3000 milestone on Monday. The cryptocurrency rose surprisingly higher on Monday as the dominance of Bitcoin started reducing.

The rising prices of Ethereum made the co-founder Vitalik Buterin the youngest crypto billionaire as he reportedly holds over 330 thousand ETH, which amounts to more than $1 billion. The recent surge in Ethereum prices over the past four months has been associated with the success of digital collectibles and the NFT boom, along with the rise in DeFi products that are popular on the network.

S&P Dow Jones Indices launched three new cryptocurrency indices that will easily allow retail traders to gain exposure to BITCOIN and Ethereum. The new indices can be used as tracking and benchmarking tools in the legacy finance world. Three indices named Bitcoin Index, S&P Ethereum Index, and S&P Crypto Mega Cap Index will prevent investors from connecting to potentially shady cryptocurrency APIs that may not necessarily provide correct pricing data. S&P hopes that it will make it easier for investors to access the cryptocurrency asset class, and they claim that this will also reduce some of the risks of the speculative & volatile crypto market. This move from S&P added strength to Ethereum prices that were already high on the board. The crypto space was challenging mainstream institutions as Ethereum is currently overtaking several traditional institutions such as PayPal and Bank of America by market valuations. Ethereum-based Defi also passed a high of $78 billion and opened up opportunities for other tokens and coins to increase their market value. The reduced dominance of Bitcoin due to the increased number of other tokens drawing the market’s interest also helped Ethereum remain higher and rise continuously.

ETH/USD Daily Technical Levels

3110.52 3586.05

2793.50 3744.56

2634.99 4061.58

Pivot Point: 3269.03

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account