USD/CAD Heads for the Lows at 1.20, as Canadian GDP Jumps

USD/CAD moves closer to 1.20 as Oil and Canadian GDP keep pushing CAD higher

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

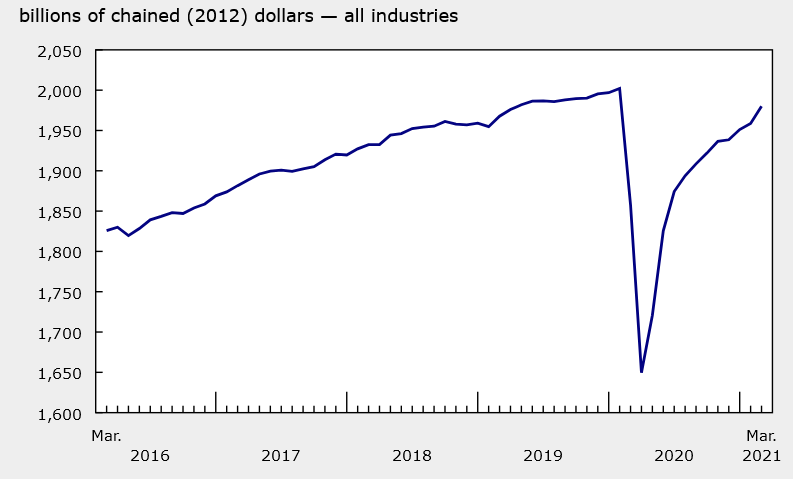

In Canada, we have seen some severe coronavirus restrictions and lockdowns during the recent months, so expectations were for a contraction in the GDP, as happened in Europe during winter. But the Canadian economy has shows some resilience, probably getting a helping hand form the US, where the economy has been booming since late last year.

The USD/CAD has been on a bearish trend for more than a year, helped by the increasing oil prices, which jumped higher today after OPEC+ decided to keep production as it is until July, despite the increasing demand, due to the current great expansion in the global economy.

Will the support above 1.20 be broken soon in the USD/CAD?

Today, the Canadian GDP beat expectations, increasing by 1.1% for April, so the CAD has two reasons to rally today, pushing the USD/CAD down in the process. This pair found support above 1.20 last month, but it’s returning down there again now and will probably break below it soon.

Canadian March and Q1 GDP

- March GDP +1.1% m/m vs +1.0% expected

- February was +0.4% (unrevised)

- Q1 GDP annualized+5.6% vs +6.8% expected

- Q4 2020 GDP was +9.6% annualized

- Canadian GDP +6.6% y/y vs +6.5% expected

- April prelim estimate -0.8% m/m

- Full report

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM