US Dollar Firm as Focus Shifts to Inflation And Other Central Banks

At the start of a fresh trading week, the US dollar appears to have steadied after posting the most severe loss seen in more than a month over the past week, with investor focus shifting on the effects of high inflation on central banks’ monetary policies around the world. At the time of writing, the US dollar index DXY is trading at around 93.54.

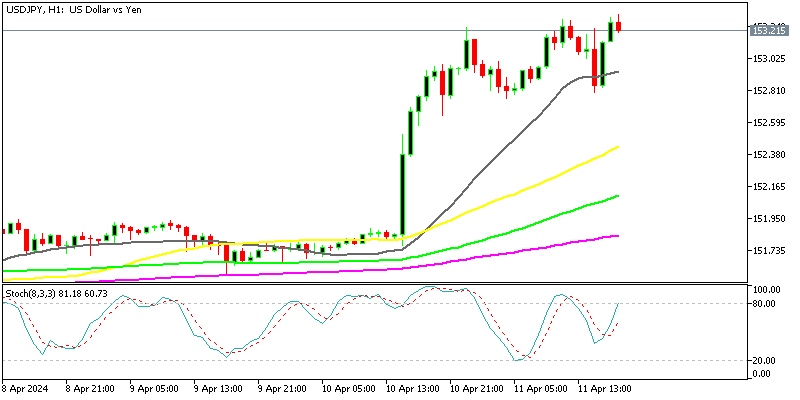

During the previous session, the greenback nursed some losses against the safe haven currency Japanese yen after Fed Chair Powell’s comments. Powell spoke about the need to start trimming monthly asset purchases – a move that is scheduled to start next months. However, he maintained that it was still too soon to think about hiking interest rates again, driving investors away from the reserve currency.

Powell’s comments dampened expectations among investors that the Fed could start announce its first rate hike since the pandemic as soon as H2 2022. Although, these hopes are no longer supporting the US dollar as markets expect other central banks to also advance their timelines for rate hikes in the wake of persistently high inflation.

However, Monday sees the US dollar regain some attention, keeping other leading currencies under pressure. Commodity currencies AUD and NZD are holding under multi-month highs breached last week while EUR and JPY also trade slightly weaker.

Meanwhile, GBP/USD continues to trade bullish over rising expectations for an upcoming rate hike by the BOE during its policy meeting next week. Markets anticipate a 60% likelihood of the BOE increasing interest rates to offset the impact of surging inflation.