BOC Neutrality Keeps USD/CAD Bullish

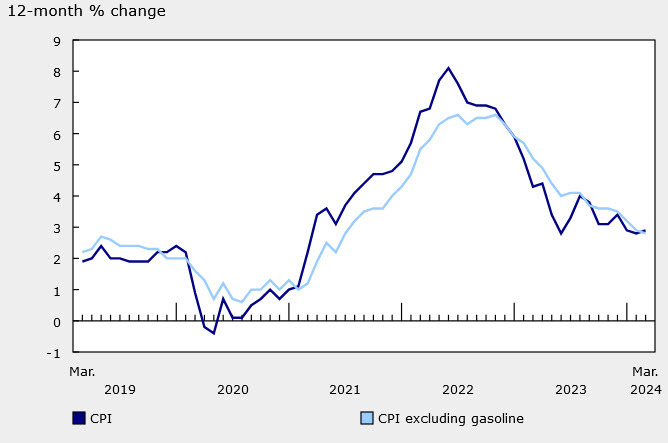

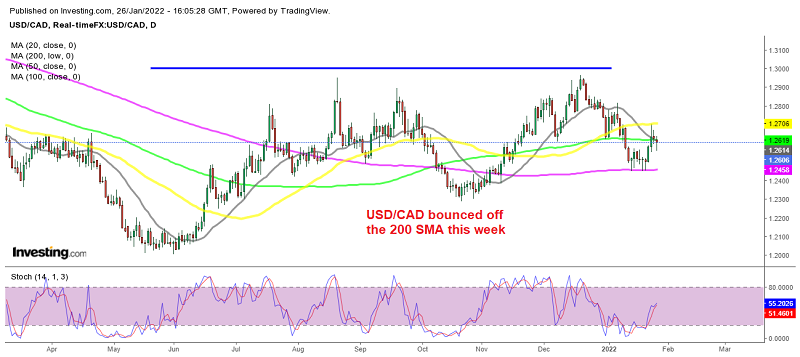

The Bank of Canada held its meeting today. They decided to keep the interest rates on hold and they sounded hawkish. But the market had priced in a more hawkish conference, so they weren’t too pleased about it, and the Canadian Dollar turned bearish, causing the USD/CAD to remain bullish after the reversal higher earlier this week. Inflation has been increasing, but it’s far from the levels we have seen in the US, so the Bank of Canada (BOC) isn’t under too much pressure. Below, you can see the decision and the highlights of the BOC meeting:

BOC Rate Decision and Highlights

- Bank of Canada holds rates at 0.25%

- Markets were pricing in a 70% chance of a hike

- Most economists expected the BOC to leave rates unchanged

- Prior was 0.25%

- BOC says overall, economic slack now absorbed

- “Looking ahead, the Governing Council expects interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2% inflation target.”

- BOC removed its exceptional forward guidance on its policy interest rate

- Says US economy is growing robustly while growth in some other regions appears more moderate, especially in China, due to current weakness in its property sector

- BOC sees growth of 4% in 2022 and 3.5% in 2023

- H2 2021 now looks to have been even stronger than expected

- The Omicron variant is weighing on activity in the first quarter

- Economic growth is then expected to bounce back and remain robust over the projection horizon

- The labour market has tightened significantly

- Persistent supply constraints to keep inflation close to 5% in H1 2022

- Inflation is expected to decline reasonably quickly to about 3% by the end of this year and then gradually ease towards the target over the projection period

- After hiking, the BOC “will consider reducing the size of its balance sheet” via rolloff

- Full text of the BOC statement

- Full text of the MPR (pdf)

This is a surprise, and USD/CAD has quickly jumped to 1.2620, however the commentary is clear – a hike is coming in March, and that slack has been absorbed. That sets the BOC on a path for consistent rate hikes. Waiting until March is likely an effort to keep Canadian rates from diverging from the US, though I expect that’s only a matter of time.

More details on forecasts:

- Output gap in Q4 was -0.75% to +0.25% compared to Q3 estimate of -2.25%

- 2021 inflation averaged 3.4%, in line with Oct estimate

- 2022 inflation seen at 4.2% vs 3.4% in Oct

- 2023 inflation still seen at 2.3%

- Q4 GDP seen at 5.8% vs 4.0% in Oct

- Q1 seen at +2.0% annualized

- 2021 GDP was 4.6% vs 5.1 in Oct

- 2022 seen at 4.0% vs 4.3% in Oct

- 2023 seen at 3.5% vs 3.7% in Oct