Forex Signals Brief for June 22: Inflation Keeps Increasing Globally

Yesterday’s Market Wrap

After the decline in risk assets last week, on Monday markets were quiet as the US was off for a bank holiday weekend. But yesterday the price action in financial markets was pretty quiet as well, although we predicted that the economic calendar is scarce this week, apart from today, so it’ll take some time until markets wake up from the long weekend.

Canadian retail sales posted some positive numbers for April, as inflation took a while to pick up in Canada after Europe and the US. Although the attention was on the Reserve Bank of Australia (RBA) meeting minutes from the last meeting when they hiked interest rates by 50 bps in a surprise move. Markets were unsure whether the RBA could keep up the pace of 50 bps hikes, which they refused, so the AUD was soft throughout the day.

The Data Agenda Today

Today we have the May CPI (consumer price index) inflation reports from Britain and Canada, which are the most important event for this week, together with Jerome Powell’s testimony in front of the US Congress. Inflation is expected to increase in both countries, which will mean further interest rate increases from the Bank of Canada (BOC) and the Bank of England (BOE).

The FED chairman Jerome Powell will testify in the US Congress and we will hear what he has to say about inflation and the future of the FED policy, interest rates in particular. This will probably decide the fate of the USD for the next few weeks, as well as set the risk tone in financial markets.

Forex Signals Update

On Monday we had mixed results with forex signals, closing it with two winning and two losing trades, as markets failed to pick a direction. Yesterday we increased our efforts and closed the day with three winning signals in forex Gold and Oil and left several more open, including one in ETH/BTC which we will talk about below.

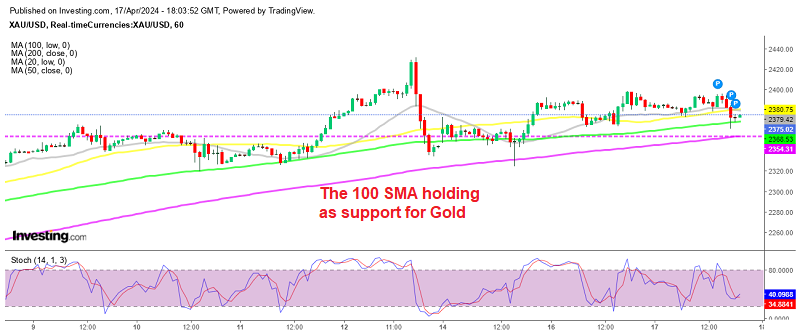

GOLD – Sell Signal

Gold has been on a downtrend since March, despite the elevated risk in financial markets, particularly with the increased possibility of a global recession due to central banks hiking interest rates and prices surging higher. But, it seems like it has lost the safe haven status and Gold is trading mostly as a risk asset. Highs have been getting lower so we decided to open another sell signal after the rejection by moving averages recently.

XAU/USD – H4 chart

WTI Crude Oil – Sell Signal

Crude Oil turned really bullish since March as global tensions increased, leading to the sanction by the EU on Russian Oil and Gas. But Russia is selling its energy to China on the other hand. Although, last week oil turned bearish after climbing above $123 and on Friday we saw a big crash. Yesterday we decided to sell Oil after the retrace higher to the 20 SMA (gray) which turned into resistance.

US Crude Oil – 240 minute chart

Cryptocurrency Update

Cryptocurrency traders are evaluating the situation after the reversal since Sunday. last week we saw another brutal selloff in the crypto market, but since Sunday they have been pulling back up. Although there’s not much strength behind this move, although big journeys always start with a small step.

LITECOIN Retesting the 100 SMA Again

Litecoin also crashed lower in recent weeks, falling to $40.50 on Saturday as the crash in cryptocurrencies continued. But since Sunday cryptocurrencies have been crawling higher, claiming back all the losses from the previous day and testing the sellers. LTC/USD climbed even higher, reaching $56 on Saturday. That means more than 25% gain in a day and we decided to open a buy signal here, but the 100 SMA (green) continues to act as resistance on the H4 chart, which rejected LTC again.

LTC/USD H4 chart

Shorting ETH/BTC

ETH/BTC turned bearish in December last year, and has been on a downtrend, with moving averages acting as resistance on the H4 chart. The latest retrace higher ended below the 100 SMA (green) and we decided to open a sell signal, as sellers are still in control.

ETH/BTC – Daily chart