nzd-usd

NZD/USD Resumes Decline With BusinessNZ Manufacturing Index in Contraction

Skerdian Meta•Friday, April 12, 2024•1 min read

The rate of NZD to USD has lost 4 cents since the start of 2024 and the economic data is not helping much. The Reserve Bank of New Zealand held interest rates unchanged in this week’s meeting and they didn’t offer any rate cut hints yet, which the market took as hawkish, but the broader situation is not helping buyers.

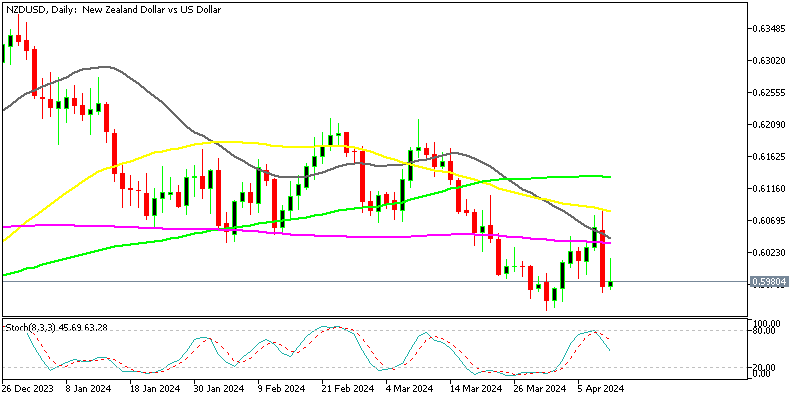

NZD/USD Chart Daily – The 50 SMA Has Turned into Resistance

NZD/USD has been experiencing a bearish trend since the beginning of the year, dropping below the 0.60 level last week. However, there was a reversal last Friday, with the pair climbing back above 0.60 to reach 0.6080, despite strong US Non-Farm Payrolls (NFP) reports and a hawkish Reserve Bank of New Zealand (RBNZ) stance. The upward movement was halted by the 50-day Simple Moving Average (SMA), indicated by the yellow line, which acted as resistance.

Subsequently, a bearish reversal occurred following the release of a strong US Consumer Price Index (CPI) inflation report on Wednesday. This price action suggests that market sentiment shifted, with traders potentially reassessing their positions in response to the economic data releases and central bank policies. The strong inflation report from the US likely contributed to renewed concerns about inflation and its potential impact on monetary policy, leading to the bearish reversal in the NZD/USD pair.

New Zealand BusinessNZ Manufacturing Index for March

- March BusinessNZ Manufacturing Index 47.1 points, the lowest since December last year

- Manufacturing PMI contracts for the 13 month in a row

- has now been in contraction for 13 consecutive months, the longest since 2009

BNZ’s Senior Economist Doug Steel:

- Tthe PMI’s average for the first quarter of the year is consistent with manufacturing GDP posting another quarter that is below that of a year earlier”

NZD/USD Live Chart

NZD/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

15 hours ago

Save

Save

16 hours ago

Save

Save

18 hours ago

Save

Save