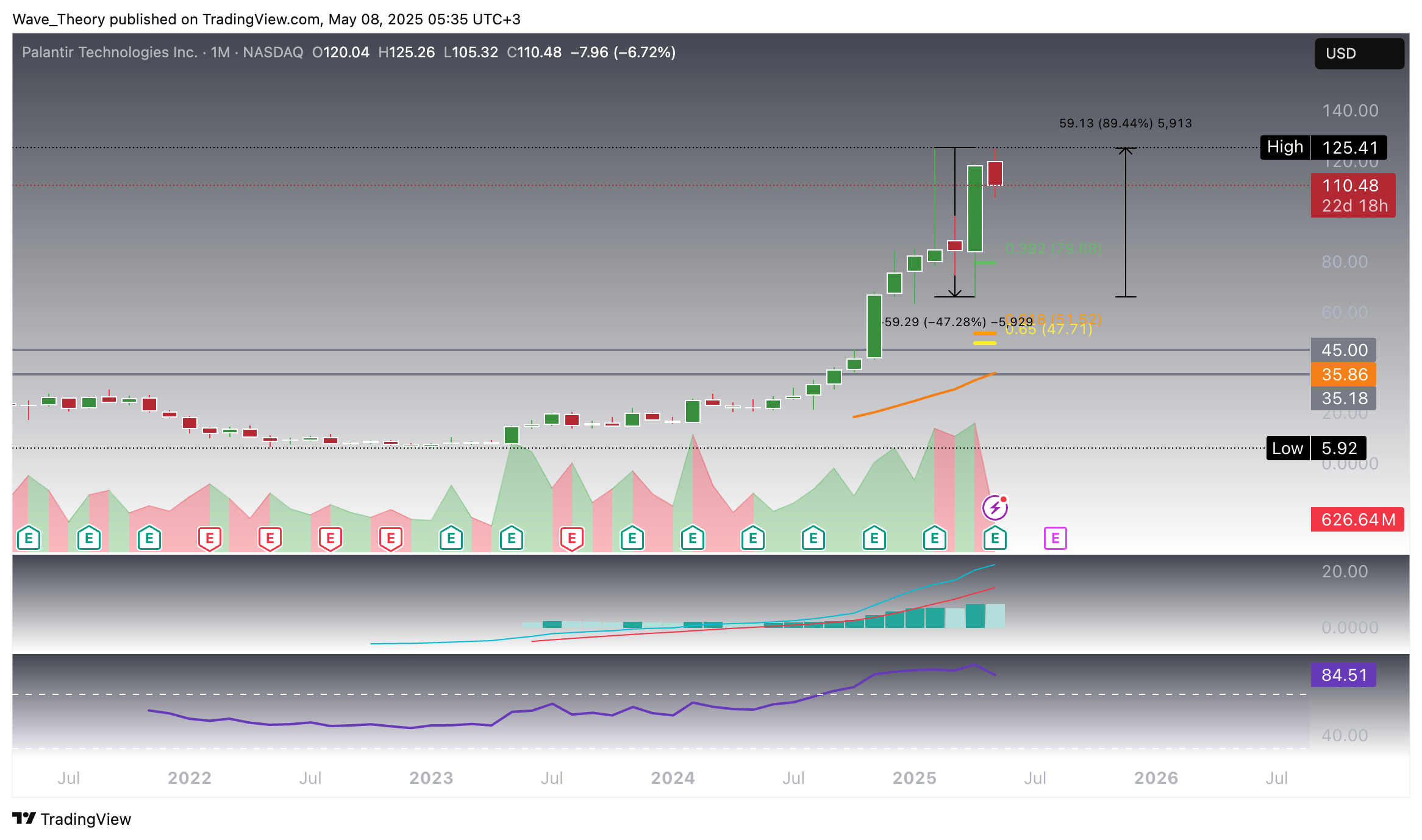

Palantir stock (PLTR) has corrected over 47% from its all-time high of $125, set just four months ago, retracing sharply to a low of $66 last month. Since then, the stock has staged an aggressive rebound of nearly 90%, signaling a potential V-shaped recovery and drawing renewed attention from momentum traders and institutional quants alike.

Palantir Stock (PLTR) Soars 90% After 47% Drop – More Upside Ahead?

Last updated: Wednesday, June 4, 2025

Quick overview

- Palantir stock (PLTR) has rebounded nearly 90% after a significant correction from its all-time high of $125, reaching a low of $66 last month.

- Despite the recent recovery, signs of exhaustion are emerging, with bearish patterns and momentum indicators suggesting potential short-term pressure.

- Key Fibonacci support levels are identified at $79.70 and $50, which are crucial for maintaining the broader bullish trend.

- If upward momentum resumes, Palantir could see an upside potential of approximately 13% before facing major resistance around the $125 level.

Palantir (PLTR) Recovers By Almost 90%

Palantir (PLTR) has entered a highly volatile cycle over the past four months, briefly breaking below the 0.382 Fibonacci support at $79.70 to mark a temporary low at $66.11. Since then, it has surged by approximately 89.4%, reclaiming its all-time high at $125.41 this month, though momentum is showing early signs of exhaustion with the histogram ticking lower, even as the MACD remains bullishly crossed and the RSI holds firm in overbought territory without issuing bearish divergence.

So far, this month has leaned bearish, with price action turning lower after the recent high. Should Palantir (PLTR) enter another corrective phase, the next key Fibonacci support levels lie at $79.70 and $50. Crucially, as long as the stock holds above the golden ratio at $50, the broader bullish trend remains structurally intact.

Bearish Double Top Pattern Threatens The Palantir Stock Price (PLTR)

After two strong bullish weeks, Palantir (PLTR) is showing signs of rejection at the recent all-time high of $125.41, raising the risk of a potential bearish double top formation. This could initiate a deeper correction toward key Fibonacci support levels, with confluence from a developing bearish RSI divergence and a MACD histogram that has started to tick lower this week. However, the mid-term outlook remains supported by bullish MACD and EMA crossovers, suggesting that while short-term pressure may increase, the broader uptrend remains intact—so long as critical support levels hold.

Palantir (PLTR) Stock: More Bearish Signals On The Daily Chart

On the daily chart, Palantir (PLTR) continues to exhibit a golden EMA crossover, confirming the bullish trend in the short- to medium term. However, momentum is waning, with the MACD lines nearing a bearish crossover and the histogram printing three consecutive days of lower ticks. The RSI is currently drifting in neutral territory, offering no strong directional bias. If the retracement deepens, PLTR faces notable Fibonacci support at $102.65 and $87, where a bullish bounce remains possible to resume the broader uptrend.

Palantir Eyes Potential Upside of Up To 13 %

On the 4H chart, the indicators align closely with the daily chart. The EMAs maintain a golden crossover, confirming the bullish trend in the short term. However, the MACD lines remain bearishly crossed, and the histogram continues to trend lower, reflecting ongoing bearish momentum, while the RSI drifts within neutral territory. Should Palantir (PLTR) regain upward traction, it holds upside potential of approximately 13% before encountering major resistance around the $125 level.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.

Related Articles

Sidebar rates

HFM

Related Posts

Doo Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals