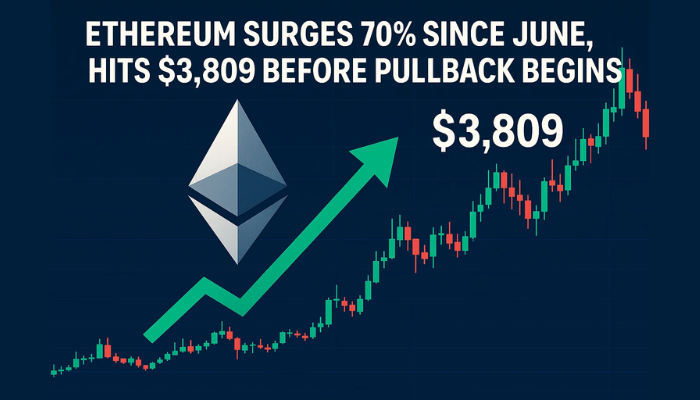

Ethereum Surges 70% Since June, Hits $3,809 Before Pullback Begins

Ethereum (ETH) is outpacing the rest of the market, up 70% since June and 25% in the last week. On Monday,

Quick overview

- Ethereum (ETH) has surged 70% since June and is currently trading at $3,678 after reaching a high of $3,809.

- Major altcoins are also experiencing gains, with Dogecoin (DOGE) up 10.37% and XRP holding above $3.50.

- All eyes are on Fed Chair Jerome Powell's upcoming speech amid rising inflation concerns and political pressure.

- US-EU trade talks show signs of progress, potentially reducing proposed tariffs before the August 1 deadline.

Ethereum (ETH) is outpacing the rest of the market, up 70% since June and 25% in the last week. On Monday, ETH traded at $3,678 after briefly hitting $3,809—its highest since March. As the total crypto market cap approaches $4 trillion, Ethereum is the leader of this rally.

Other major tokens are participating in the upswing. Bitcoin (BTC) is steady at $118,000, while alts are up across the board. Dogecoin (DOGE) is up 10.37% to $0.279 and XRP is holding above $3.50. According to Coinglass, $365 million in crypto positions were liquidated in the last 24 hours, with $210 million of that in short trades—showing how fast sentiment is shifting.

DOGE futures open interest is up 17% to $5 billion.

Powell’s Speech and EU Tariff Talks in Focus

All eyes are on Fed Chair Jerome Powell who speaks tomorrow as inflation concerns rise. June’s CPI came in hotter than expected and the odds of a rate cut have decreased. But traders are listening for any hints of future easing.

Political pressure adds to the complexity. Former President Trump has called for Powell’s resignation and a 300 basis point rate cut—something Powell has resisted. With his term ending in May 2026, any sign of policy shift or early exit will rattle markets.

Meanwhile, trade talks between the US and EU could ease soon. Commerce Secretary Howard Lutnick said progress is being made towards a deal and the proposed 30% tariffs could be lowered to 15-20%. With the August 1 deadline approaching, signs of compromise are boosting risk appetite across markets.

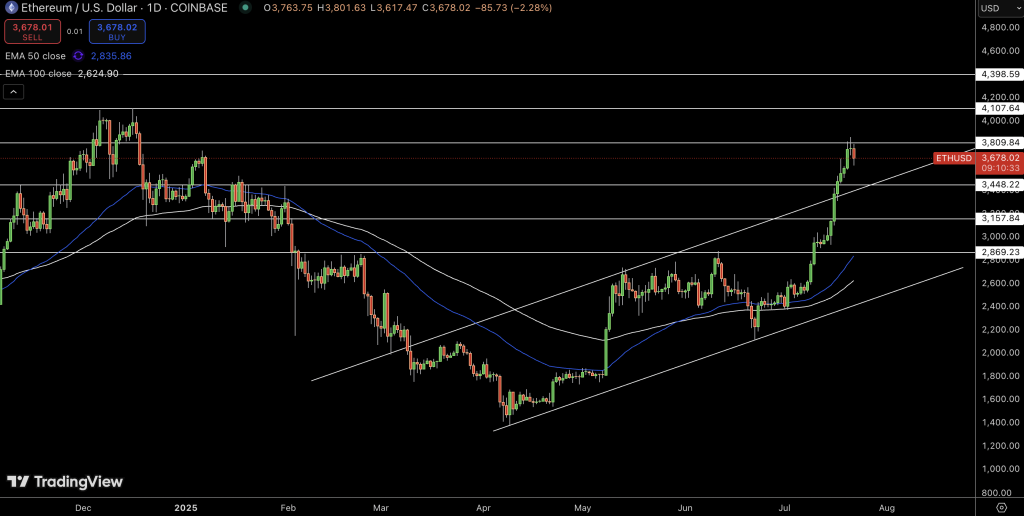

Ethereum Technical Picture Signals Breather

After the explosive move from the June lows, Ethereum is looking short term exhausted. Price stalled just below $3,809—an important resistance zone that has triggered selloffs in the past. Friday’s daily candle was a shooting star, a common reversal pattern, followed by a minor bearish engulfing candle.ETH is consolidating at $3,678 but is above its 50-day EMA at $2,835 and 100-day EMA at $2,625. The wide gaps are healthy for a short term breather. The RSI is near 70, so the rally is still intact but slightly overbought.

A level to watch is $3,448 where the previous resistance meets the channel’s support. If price retrace to this zone and print a bullish reversal (like a hammer or engulfing candle) it could trigger the next move up to $4,107.

Quick Points:

- Ethereum up 25% this week, trading at $3,678

- ETH hit $3,809 before rejecting at resistance

- Powell speaks tomorrow

- US-EU tariff talks look like they will compromise before August 1

- Alts up, DOGE 10.37%, XRP above $3.50

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM