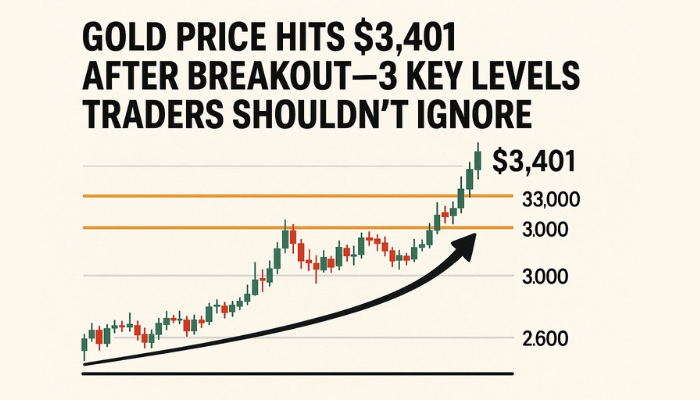

Gold Price Hits $3,401 After Breakout—3 Key Levels Traders Shouldn’t Ignore

Gold (XAU/USD) is back in focus after a clean breakout above the symmetrical triangle, up to $3,401 and then consolidating.

Quick overview

- Gold (XAU/USD) has broken out above the symmetrical triangle, currently trading at $3,389, indicating a bullish sentiment amid global uncertainty.

- Key support levels include $3,380 and the 50 SMA at $3,356, while resistance levels to watch are $3,401, $3,416, and $3,430.

- The RSI has cooled to 63 after reaching overbought levels, suggesting a potential for further upside if macroeconomic conditions remain favorable.

- As long as gold stays above $3,374, the bullish breakout remains valid, with dips potentially offering buying opportunities.

Gold (XAU/USD) is back in focus after a clean breakout above the symmetrical triangle, up to $3,401 and then consolidating. This is a big shift in sentiment as gold rides the wave of global uncertainty, Fed expectations and dollar weakness.

Currently at $3,389, gold is above both $3,380 psychological support and the 50 period simple moving average (SMA) at $3,356 which is now a trend defining dynamic support. The previous triangle resistance at $3,374 has flipped into a near term demand zone, so the bias is bullish.

On the 2 hour chart the breakout candle was backed by strong volume and RSI momentum – technical signs that confirm the bulls are in control.

Gold Key Price Levels to Watch

With the triangle breakout intact and RSI still in buyers favour, the bulls are looking at key resistance levels ahead.

Upside targets:

- $3,401 – Initial breakout high

- $3,416 – Resistance from previous consolidation zone

- $3,430 – Multi week high from early June

A clean break above $3,401 could accelerate buying especially if the dollar weakens or economic data is dovish.

If gold fails to stay above $3,389-$3,374 the traders will be looking at:

- $3,374 – Retest of triangle apex

- $3,360 – Short term horizontal pivot

- $3,356 – 50 SMA dynamic support

- $3,344-$3,332 – Triangle base and structure bottom

These areas could offer buying interest if price dips and RSI resets.

RSI Cooling but Macro still Bullish

The RSI has pulled back to 63 after briefly touching 70 overbought, so momentum is slowing but not reversing. This kind of RSI cooling is common after strong breakouts and often precedes more upside if macro drivers stay supportive.

Gold’s bigger picture is still constructive. With China uncertainty, Middle East tensions and a US rate cut later this year, safe haven demand is driving capital into bullion. Today’s minor pullback may be profit taking but longer term flows are still favouring gold over risk assets.As reported by Reuters earlier today, gold pulled back from 5 week highs as investors took profits. But institutional demand and a weaker dollar could keep the bull case alive if economic data shows slower US growth or disinflation.

Conclusion

As long as $3,374 holds the breakout is valid. A daily close above $3,401 could take XAU/USD to $3,416 and then $3,430. Momentum is cooling but the structure is still in place. Dips could be buying opportunities as long as price is above $3,356.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM