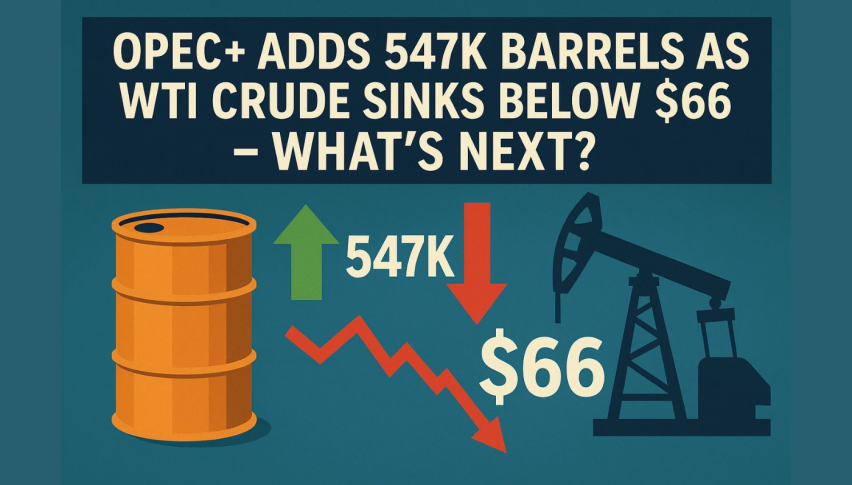

OPEC+ Adds 547K Barrels as WTI Crude Sinks Below $66 – What’s Next?

Oil prices extended their losing streak on Tuesday, marking the fourth consecutive session in the red, as oversupply fears gripped...

Quick overview

- Oil prices have fallen for four consecutive sessions due to oversupply concerns and weak demand forecasts.

- OPEC+ plans to increase output by 547,000 barrels per day in September, raising worries about a fragile global economy.

- Geopolitical tensions, particularly between the U.S. and India over Russian oil imports, are adding to market uncertainty.

- Technical indicators suggest a bearish trend for WTI crude, with potential price targets below $66.79.

Oil prices extended their losing streak on Tuesday, marking the fourth consecutive session in the red, as oversupply fears gripped the market. Despite tepid demand forecasts, OPEC+ has announced an additional output increase of 547,000 barrels per day (bpd) for September—an early reversal of some of its largest cuts. While the full return of the 2.5 million bpd remains unlikely, the move has raised concerns among traders already wary of a fragile global economy.

Phillip Nova’s senior analyst Priyanka Sachdeva noted that rising OPEC+ supply is offsetting potential shortfalls from Russia. This buffer comes just as geopolitical risks remain high, including escalating tariff tensions between the U.S. and India over Russian oil imports. President Trump recently threatened a 100% tariff on buyers of Russian crude and reiterated the threat toward India, deepening trade frictions.

China’s July Politburo meeting further dampened sentiment by signaling a pivot toward long-term structural reforms rather than short-term stimulus. Add JPMorgan’s note warning of stalled labor demand and growing U.S. recession risks, and the outlook for oil demand appears increasingly soft.

WTI Crude Breaks Below $66.79 Support

Technically, WTI crude (USOIL) is flashing red signals. After breaking below a long-standing trendline, the commodity has struggled to recover. The 2-hour chart shows a failed retest of both the trendline and the 50-period Simple Moving Average (SMA), now sitting at $68.37.

A spinning top followed by a sharp bearish candle near $66.79 confirms that sellers are in control. Price action is also forming a textbook lower high and lower low sequence, solidifying a short-term bearish trend. RSI has slipped to 36.16, with no bullish divergence in sight, hinting that downside momentum may persist.

If WTI closes below $65.58, the next stops could be $64.71 or even $63.84—levels that align with previous support zones.

Crude Oil Trade Setup: Short Opportunity Below $66.79

Traders eyeing a short setup should watch for price rejection at the former support of $66.79. The failed trendline retest and bearish candlestick signals offer a clear roadmap for bears.

Here’s a trade idea for newer traders:

- Entry: If price retests $66.79 and forms a bearish candle (e.g., shooting star or bearish engulfing)

- Target 1: $65.58

- Target 2: $64.71

- Stop-Loss: Above $67.20 (above SMA and trendline)

Tip: Let the market confirm weakness. If RSI dips below 30 on a strong red candle, momentum could accelerate. No need to guess—follow structure and signals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account