JSE Top 40 Holds 93,400 Ahead of Inflation Data: Key Levels to Watch

The small drop is a temporary pullback ahead of the big economic numbers. Investors are waiting for local inflation and global cues.

Quick overview

- The recent drop in the market is seen as a temporary pullback as investors await key economic data on inflation.

- The rand remains stable ahead of the July consumer inflation report, which is crucial for the SARB's rate decisions.

- Investor sentiment is cautious, with potential volatility depending on inflation outcomes and global cues from the Fed's symposium.

- The JSE Top 40 index is testing critical support levels, indicating market indecision, but remains bullish unless key support levels are breached.

The small drop is a temporary pullback ahead of the big economic numbers. Investors are waiting for local inflation and global cues.

Rand and Inflation Influence Markets

The rand was quiet in early trade on Wednesday as we wait for July consumer inflation from Stats SA at 0800 GMT. Economists are expecting 3.5% year-on-year from 3.0% in June.

The inflation number is key for the SARB’s rate decisions. Higher inflation could mean tighter policy and pressure on equities, while stable inflation could keep bond yields and stocks steady.

Early market indicators:

- 2035 government bond yield: 9.655% flat

- U.S. dollar: flat against majors

- Rand: no movement

Investor Caution Shapes Trading

Investor sentiment is cautious as we wait for the central bank to make their next move. Bonds are steady and the U.S. dollar is flat so no immediate disruption. But any big deviation from the numbers could change expectations:

- Higher inflation: rate hikes and pressure on equities

- Stable inflation: steady equity performance

- Global cues: Fed’s Jackson Hole Symposium could influence risk appetite

Overall the JALSH is showing investors are taking a measured approach, balancing local inflation data with global monetary signals. Short term volatility may continue but fundamentals suggest steady unless we get big surprises in the numbers.

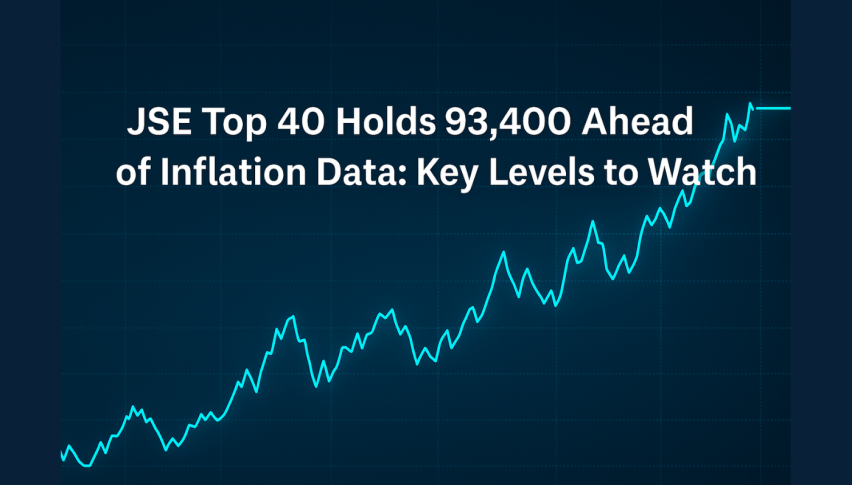

Technical Outlook – JSE Top 40 Index

The JSE Top 40 is testing a big level at 93,400 ZAR, just above the 50-period SMA at 92,855 and a rising trendline that has supported higher lows since late July. Price action is showing a series of pullbacks from the 94,242 Fibonacci extension and is now consolidating with smaller bodied candles that indicate market indecision.

Momentum indicators are confirming the stalemate. The RSI is at 46, momentum is cooling and the MACD histogram has turned negative with a bearish signal-line crossover. This divergence between the strong price structure and fading momentum means we need to be alert.The recent candles are showing a mini three black crows, which can be a warning of more downside. But the bigger picture remains bullish above the 92,855–92,800 support zone so the bias is still up unless these levels break.

Trade: A conservative long can be entered near 92,850–93,000 with stops at 91,450. Upside targets at 94,240 and 94,950 if momentum returns. Aggressive traders can short a close below 92,800 and target 91,450.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account