Allianz SE Stock Reaches New All-Time High but Faces Short-Term Struggles

Quick overview

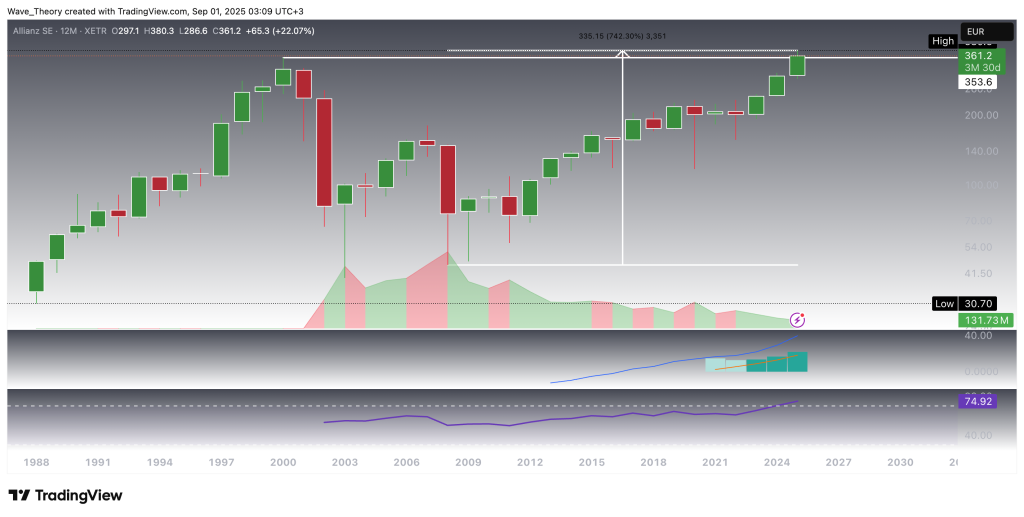

- Allianz SE stock has experienced significant growth, achieving over 742% gains since 2018 and reaching a new all-time high of $380 this year.

- Despite its long-term strength, the stock is currently facing short-term headwinds, including bearish divergence and a potential correction.

- The MACD lines remain bullish, indicating a constructive mid-term outlook, while the stock may retrace towards key support levels around $328 and $280.

- Short-term downside risk is estimated at approximately 6.4%, but the overall trend remains bullish due to supportive exponential moving averages.

Allianz SE stock has been on a remarkable growth path since 2018, delivering gains of more than 742%. This year, shares reached a new all-time high of $380, marking a major milestone for the German insurance giant. However, despite the long-term strength, the stock is now encountering short-term headwinds that could test investor sentiment.

Allianz SE Stock Hits New ATH At $380

For nearly two decades, Allianz stock has demonstrated a consistent upward trajectory. This year, it achieved a new all-time high at $380, decisively surpassing its previous record of $354. On the yearly chart, the MACD lines have sustained a bullish cross, while the MACD histogram has been advancing bullishly for three consecutive years, confirming sustained momentum. At the same time, the RSI is approaching overbought territory, yet it has not issued any bearish divergence or reversal signals, suggesting that upward pressure remains intact despite increasingly stretched conditions.

Allianz SE Stock Sets New ATH This Month

Allianz SE stock has been under pressure over the past three months, entering a corrective phase. Over the last four months, the MACD histogram has trended lower, signaling waning momentum, even as the MACD lines remain bullishly crossed. At the same time, the RSI has formed a pronounced bearish divergence, highlighting short-term weakness. Nevertheless, this month the stock appears to be attempting a reversal out of its correction, managing to surpass its previous all-time high and set a new record at $380.

Bearish Divergence on the Weekly Chart

On the weekly timeframe, the RSI has developed a bearish divergence, and Allianz stock began to retrace last week. This correction could extend further, first targeting the 50-week EMA around $328, and potentially the 0.382 Fibonacci support at $280. Should this level fail to hold, a deeper decline toward the golden ratio (0.618 Fib) support at $210 cannot be ruled out. At this zone, Allianz would encounter significant Fibonacci support, offering a strong technical basis for a potential bullish rebound.

Despite these short-term bearish signals, the MACD lines remain in a bullish crossover, and the exponential moving averages (EMAs) continue to support the uptrend, confirming a constructive mid-term outlook. Additionally, the MACD histogram is trending higher, reinforcing the underlying bullish momentum.

Allianz Stock Price Could Decline by Another 6.4%

In the short term, Allianz stock faces further downside risk of approximately 6.4%, with price action potentially retracing toward the 200-day EMA at $334. The MACD histogram is trending clearly lower, and the MACD lines have crossed bearishly, reinforcing short-term weakness.

However, the RSI remains neutral, and the exponential moving averages (EMAs) continue to maintain a golden crossover, thereby confirming the broader trend as bullish in the short- to medium-term horizon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM