Dogecoin Poised for Historic ETF Launch, Technical Patterns Signal Potential 550% Rally to $1.40

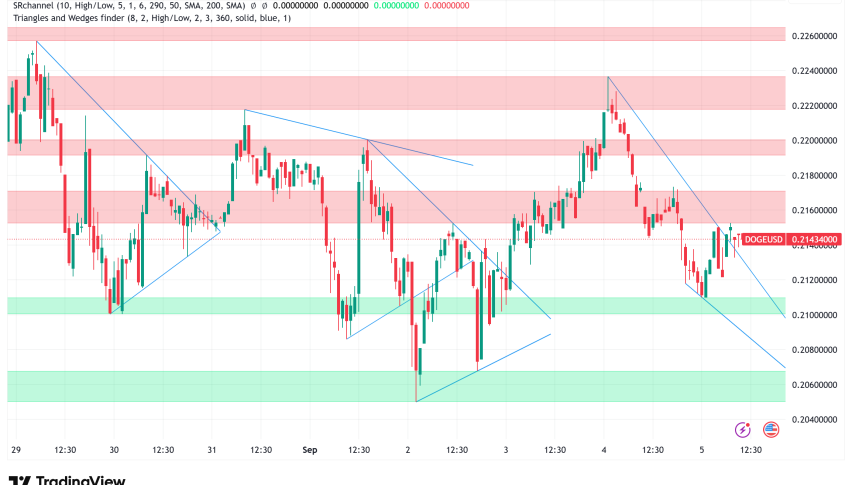

Dogecoin (DOGE) price consolidates above $0.21 support as institutional adoption momentum builds ahead of first-ever U.S. Dogecoin ETF

Quick overview

- Dogecoin (DOGE) is currently trading at $0.2145, down 1.1% in the last 24 hours, but may soon see the launch of the first Dogecoin ETF in the US.

- REX Shares is utilizing a regulatory process that bypasses traditional requirements, having already submitted a valid prospectus to the SEC.

- CleanCore Solutions has adopted DOGE as its main treasury reserve asset, marking a significant step for institutional adoption of the cryptocurrency.

- Technical analysis suggests a potential bullish breakout for DOGE, with targets of $1.40 and $0.37 depending on market movements.

Dogecoin DOGE/USD is trading at $0.2145, down 1.1% in the last 24 hours, but the memecoin monster may be about to reach a historic milestone. Eric Balchunas, an analyst at Bloomberg, said that REX Shares could start the first Dogecoin exchange-traded fund in the US as soon as next week.

First Dogecoin ETF Could Launch Within Days

REX Shares is following the “40 Act” regulatory process, which is the same path they took to launch their successful Solana staking ETF. ETF Store president Nate Geraci calls this technique “a regulatory end-around.” It gets around the usual S-1 and 19b-4 reporting requirements that have held up other crypto ETF applications.

The SEC has already received a valid prospectus from the company, but it told investors that “DOGE is a relatively new innovation and is subject to unique and substantial risks.” In the meantime, traditional applicants like 21Shares, Bitwise, and Grayscale are still waiting for the SEC to decide on their Dogecoin ETF proposals that they sent in earlier this year.

Institutional Treasury Adoption Accelerates DOGE Legitimacy

CleanCore Solutions became the first publicly traded business to use DOGE as its main treasury reserve asset. This gave the institutional story for Dogecoin a big boost. The Nebraska-based company said it had raised $175 million in a private placement with assistance from the Dogecoin Foundation and the House of DOGE. Over 80 institutional and crypto-native investors backed the deal.

This treasury technique is similar to MicroStrategy’s Bitcoin accumulation concept and could bring in billions of dollars from institutions. According to Polymarket data, there is a 79% chance that the spot ETF will be approved in 2025. The 21Shares Dogecoin ETP has already been approved for trading in Europe.

According to CoinMarketCap data, DOGE is currently down 54% from its December 2024 high of $0.4672, but it has gone up an astounding 116.67% in the past year.

DOGE/USD Technical Analysis Points to Major Bullish Breakout

Bullish Megaphone Pattern Targets $1.40

A look at the weekly chart shows that Dogecoin is trading in a bullish megaphone formation. The price recently bounced off the lower trendline support at $0.15 in June. Analyst Bitcoinsensus calls this “a huge opportunity on the weekly time frame” and points out that previous rallies in this pattern have always been bigger than the ones before them.

The analyst said, “This next wave could lead to prices as high as $1.40,” which would be a 550% rise from where they are now. Barry ChartMonkey, another analyst, agrees with this view and sees the 3.618 Fibonacci extension at $1.15 as the “new bullish leg for the 2-year Bullish Megaphone.”

Short-Term Consolidation Sets Up Breakout

The daily chart reveals that DOGE is trending sideways in a symmetric triangle pattern. The 50-day simple moving average around $0.225 is a crucial level of resistance. If prices break out above this level, the target price would be $0.37, which is a 72% gain from where they are now.

Recent signals from the TD Sequential indicator support the bullish argument. After accurately signaling a sell signal at the local peak on Wednesday, the indicator has now flashed a buy signal after nine red candles in a row. This suggests that a short-term rebound is about to happen.

Dogecoin Price Prediction and Risk Assessment

Bull Case Target: $1.40 (550% upside)

- Successful ETF launch driving institutional demand

- Treasury adoption by additional public companies

- Completion of bullish megaphone pattern

- Maintained support above $0.21 psychological level

Conservative Target: $0.37 (72% upside)

- Breakout from daily symmetric triangle

- Recovery above 50-day moving average

- Continued retail interest and mainstream adoption

Key Risk Levels

- Immediate support: $0.205 (recent monthly low)

- Critical support: $0.19-$0.16 zone

- Invalidation below $0.15 would negate bullish megaphone pattern

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM