Boxer Retail (JSE) Tests 6,700 as Falling Wedge Narrows — Breakout or Breakdown?

Boxer Retail (JSE: BOX) traded at 6,698 on Thursday, down slightly in a market that has been lacklustre for weeks.

Quick overview

- Boxer Retail (JSE: BOX) shows resilience in a cautious South African market, trading at 6,698 despite pressures from inflation and interest rates.

- A falling wedge pattern suggests a potential bullish reversal, with key resistance at 6,784 and support at 6,692.

- Technical indicators indicate indecision, with the possibility of a breakout leading to higher targets or a downside risk if support is breached.

- Global factors, including a recent Fed rate cut, may influence market conditions and investor sentiment in South Africa.

Boxer Retail (JSE: BOX) traded at 6,698 on Thursday, down slightly in a market that has been lacklustre for weeks. While the broader South African market is cautious, Boxer’s steady performance shows resilience in the retail space even as household spending is under pressure from inflation and interest rate uncertainty.

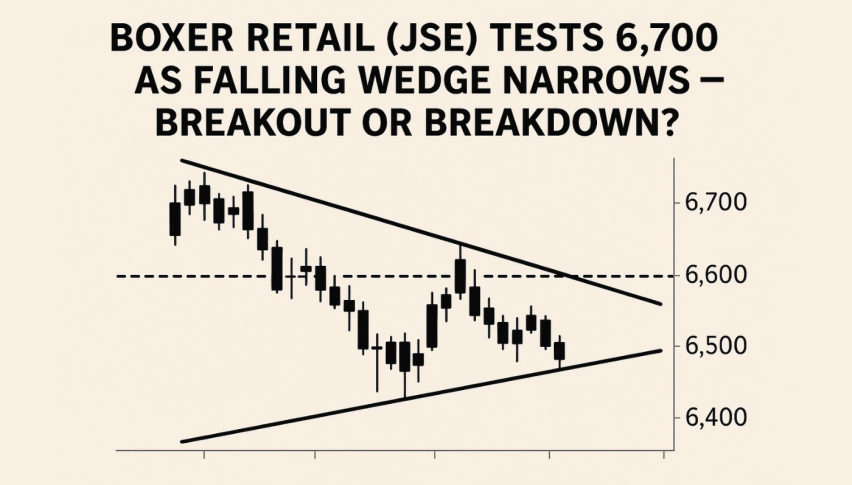

The 2 hour chart shows a falling wedge, a technical pattern that often precedes a bullish reversal. Price action has compressed between descending resistance and horizontal support with key Fibonacci retracement levels at 6,692 (23.6%) and 6,784 (38.2%) as key zones. Investors see this wedge as a sign that volatility is about to return, either through a breakout or a sharp rejection.

Boxer Retail (JSE: BOX) Technical Picture: Wedge Tightens

Candlestick action is showing indecision with multiple Doji and spinning top formations. Several false breakouts suggest that traders are getting trapped on both sides of the market. The 50 SMA at 6,708 and the 200 SMA at 6,783 are converging, which could lead to an EMA crossover if confirmed.

The RSI is flat at 49, leaving room for an upside move if momentum picks up. For traders, the setup is clear: a breakout above 6,784, ideally confirmed by a bullish engulfing candle or three white soldiers, could lead to 6,858 and then 6,932. Below 6,692 risks a retest of 6,547 and then 6,451.

Key levels to watch:

- Upside breakout: 6,784 → 6,858 → 6,932

- Downside risk: 6,692 → 6,547 → 6,451

Fed Rate Cut Adds Global Weight

Beyond local technicals, global policy is important. The US Federal Reserve cut interest rates by 25 basis points this week, taking the federal funds rate to a target range of 4.00%–4.25%. Chair Jerome Powell described it as a “risk management cut”, emphasizing a data dependent approach.

Markets are pricing in 100 basis points of easing over the next year and investors are watching US labour market and inflation. For South Africa, Fed policy matters: looser US monetary conditions can support EM flows and stability in the rand.

Locally, attention turns to South African CPI today, expected to rise to 3.6% year on year and retail sales which will give us insight into consumer health. The SARB meeting on Thursday will add to the market anticipation.

For now, Boxer Retail’s wedge is telling us to get ready for a big move. Above resistance could be an entry for longs, below is an entry for shorts. Either way, patience and candle confirmation is key in this tightening structure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM