Silver Price Outlook: $44.18 Support in Play Before 6 U.S. Data Catalysts

Silver holds at $44.18 as traders eye U.S. data and key $44.44 resistance. Technical signals point to a breakout or pullback in the near ter

Quick overview

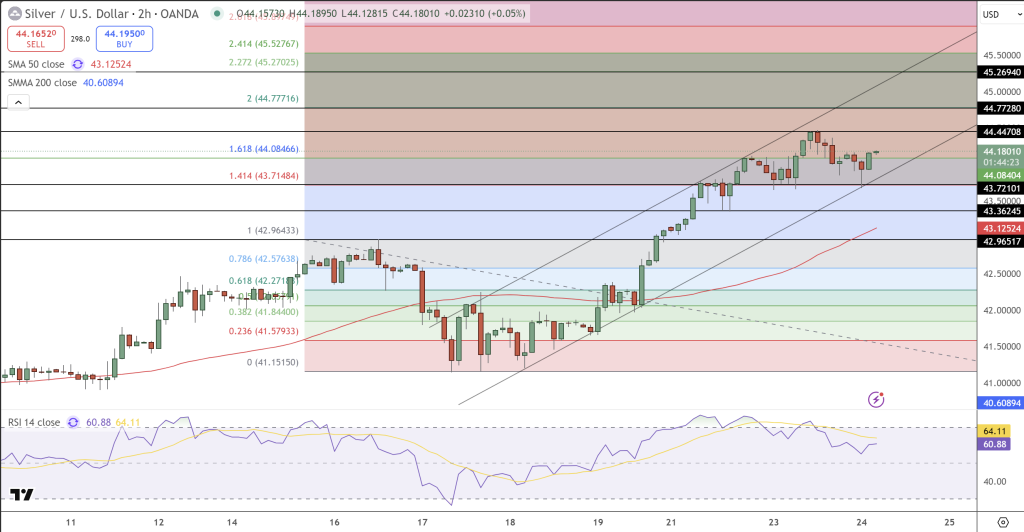

- Silver is currently priced at $44.18, having recently rallied past the $42.96 Fibonacci pivot and entered an uptrend channel.

- US economic data released on Tuesday was mixed, leading to cautious trading as markets await significant upcoming data that could impact silver prices.

- Technically, silver remains bullish but is showing signs of being overbought, with key resistance at $44.44 and support at $43.72.

- Traders should be prepared for potential volatility as upcoming economic reports could influence both the dollar and silver prices.

Silver is at $44.18 after a big rally that cleared the $42.96 Fibonacci pivot and entered a well-defined uptrend channel. The trend is still up, but price action has slowed as buyers test the resistance at $44.44.

Tuesday’s US data was mixed, and traders are cautious. Flash Manufacturing PMI was 52.0 vs 52.2 expected and 53.0 prior. Flash Services PMI was 53.9 vs 54.0 expected and 54.5 prior. The Richmond Manufacturing Index was −17, compared to −5 expected and −7 prior. Powell spoke later in the day and didn’t signal any immediate policy changes, so markets are data dependent.

Big US data ahead

Now the focus is on a big US data week that will drive silver’s next move. New Home Sales are expected today at 650k. But Thursday is the big day:

- Final GDP q/q expected at 3.3% unchanged from prior.

- Unemployment claims at 233k, vs. 231k prior.

- Core Durable Goods Orders at −0.1% m/m after +1.0% prior.

- Durable Goods Orders at −2.0% vs −2.8% prior.

- GDP Price Index (q/q) at 2.0%, steady with the prior.

- Existing Home Sales at 3.96M vs 4.01M.

Any big surprise will move the dollar and Treasury yields, and silver will react accordingly.

Silver (XAG/USD) Technical and Trade

Technically, SILVER is bullish but overbought. The price is still within the channel and bouncing between support and resistance. Recent candlesticks are displaying multiple spinning tops and doji at $44.44, indicating hesitation at this level. That often precedes a break or a correction.

Momentum indicators support this pause. RSI is at 61, down from overbought, but still with higher price lows, so no bearish divergence yet. On the moving averages, 50-SMA ($43.12) is above 200-SMA ($40.60), so the long-term trend is up, but the widening gap is a sign of momentum exhaustion.

For confirmation, watch the candle closes. A bullish engulfing candle above $44.44 will likely trigger a move to $44.77 and then $45.26. Failure to hold $43.72 will open the door to a retest of $43.12 and break the short-term trend.

Trade setup:

- Breakout play: Buy on a close above $44.44, target $44.77–45.26, stop $43.90.

- Dip-buy play: Wait for a pullback into $43.72–43.12 and then enter long with a stop just under $43.00.

The trend is still up, but with so much US data in the next 48 hours, risk management is key. Silver traders should be prepared for volatility as fundamentals and technicals converge at key levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM