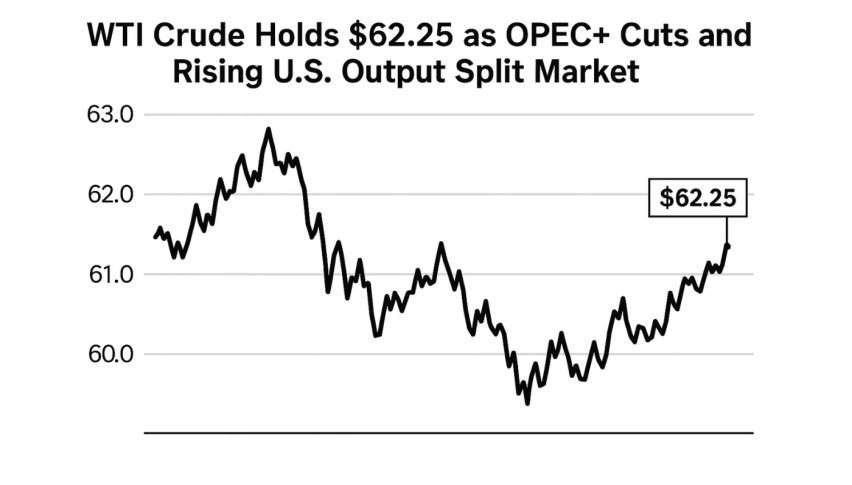

WTI Crude Holds $62.25 as OPEC+ Cuts and Rising U.S. Output Split Market

WTI crude oil futures traded near $62.25 on Wednesday as the latest OPEC+ production decision and mixed supply signals kept traders...

Quick overview

- WTI crude oil futures are trading around $62.25 as OPEC+ decisions and mixed supply signals create caution among traders.

- US oil production is projected to reach a record high in 2025, contributing to rising inventories and oversupply concerns.

- Technical analysis indicates a strong resistance zone between $62.70 and $63.30, with potential bearish and bullish scenarios for traders.

- Traders are advised to wait for confirmation before making moves, as the market remains in a descending trend despite short-term bounces.

WTI crude oil futures traded near $62.25 on Wednesday as the latest OPEC+ production decision and mixed supply signals kept traders cautious. The group’s small output increase – the smallest of the options – helped stabilize prices that were under pressure from oversupply worries. OPEC is protecting the market balance while avoiding a price collapse as demand growth slows in Asia and Europe.

But the bullish tone was challenged by the EIA’s new forecast that US production will hit a record in 2025, beating expectations. US inventories rose 2.78 million barrels last week, more than the 2.25 million-barrel build expected, as domestic supply remains resilient despite weaker refinery runs.

Russian exports are near a 16-month high but Ukrainian drone strikes have disrupted refining operations and Moscow is rerouting some shipments. The global supply picture is complex – balanced between output discipline and geopolitical tension – and traders are looking for clarity in upcoming EIA and API data.

WTI Crude Oil Technical Outlook: $63.20 Key Resistance

On the 4-hour chart, WTI crude is stuck in a descending trendline from the recent high at $66.44 and despite short-term bounces, the bigger trend is still down. Prices have bounced to the 38.2% Fibonacci at $62.70 which overlaps with the 50-SMA ($62.48) and 100-SMA ($63.24) – a strong resistance zone.

Candlestick analysis shows spinning tops and indecisive wicks, a sign that buyers are losing steam at this level. The RSI at 56 is a mild bullish bounce but not enough to confirm a breakout. Unless WTI closes above $63.20-$63.30, the probability of selling is high and prices could drop to $60.40, a strong psychological and Fibonacci support.

WTI Crude Oil Trade Setup: Rejection or Breakout

Traders have two clear scenarios for the next sessions:

- Bearish setup: Look for rejection at $62.70-$63.00 with a shooting star or bearish engulfing candle. A confirmed reversal could open up targets at $61.00-$60.40.

- Bullish scenario: A close above $63.30 would kill the bearish setup and open up to $64.10 or $65.00.

For new traders this is a great example of waiting for confirmation rather than chasing the volatility. The technicals are cautious: until oil breaks the trendline resistance the bias is down — the market is respecting gravity while still hinting at the next bounce.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM