Monero (XMR) Defies Regulatory Pressures to Hit New All-Time High of $701 as Privacy Demand Surges

Monero (XMR), the top privacy-focused cryptocurrency, is going up. It is now trading at $683, with a 6.5% gain in the last 24 hours and 52%

Quick overview

- Monero (XMR) is currently trading at $683, experiencing a 6.5% gain in the last 24 hours and a 52% increase over the past week.

- The rise in Monero's value is attributed to increasing demand for privacy-focused cryptocurrencies amid stricter regulatory measures worldwide.

- Technical indicators suggest that Monero may be entering overbought territory, with potential short-term corrections expected.

- Despite the challenges, Monero is likely to maintain its position as a leading privacy coin as regulatory pressures continue to drive demand.

Monero XMR/USD, the top privacy-focused cryptocurrency, is going up. It is now trading at $683, with a 6.5% gain in the last 24 hours and about 52% in the last week. The privacy token recently hit an all-time high of $701, making it one of the top 15 cryptocurrencies by market cap, worth $12.6 billion.

The rise occurs as more and more rules and surveillance techniques are making people want instruments that keep their financial information private. Monero has come out on top in this trend, doing much better than the rest of the cryptocurrency market.

Regulatory Tailwinds Fuel Privacy Coin Momentum

Analysts say that Monero’s rapid rise is due to stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) rules around the world. The European Union’s plan to outlaw privacy coins and anonymous crypto accounts starting in 2027 has, strangely enough, made investors more interested. This is because people are rushing to buy privacy-preserving assets before the rules go into effect.

Narek Gevorgyan, the founder and CEO of CoinStats, a platform for managing crypto portfolios, said that coins that focus on privacy are doing better because investors want to keep their financial information private. This is because surveillance is increasing in the digital economy and governments are paying more attention to crypto transactions.

Since the $19 billion crypto market crash in early October, the privacy coin sector has shown amazing strength. The entire market capitalization has gone up 3.5%, while the trading volume for privacy-focused assets has gone up 32%. Zcash (ZEC), Monero’s closest competitor, went up 12 times from its yearly low of $48 to $744, but it has subsequently dropped about 21% because of problems with governance and a lack of developer engagement.

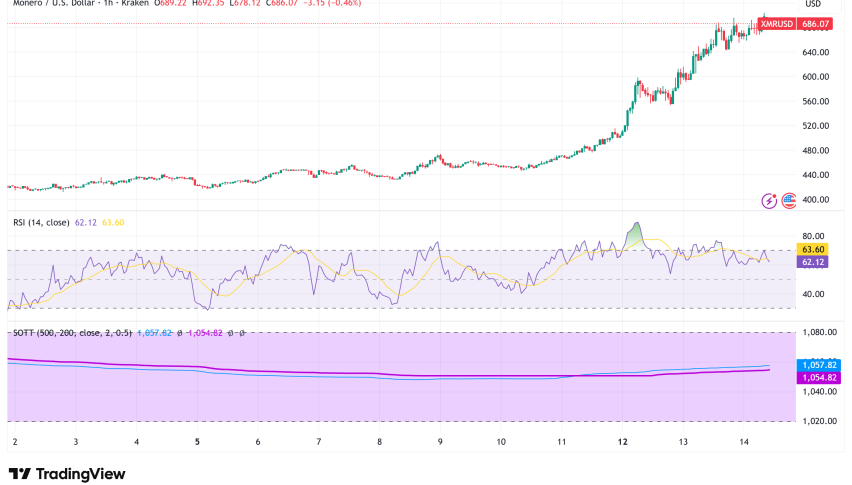

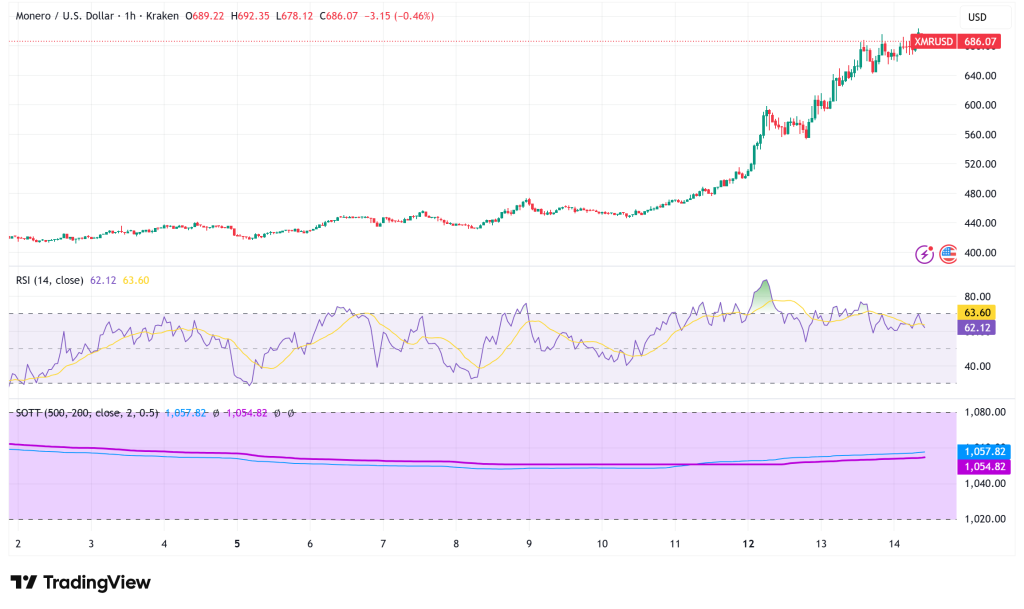

XMR/USD Technical Analysis: Overbought Conditions Signal Caution

Even though the price is going up, technical signs say that Monero may be getting into dangerous territory. The cryptocurrency was recently turned down near the 78.6% Fibonacci extension level at $701, which is a key resistance level that has stopped gains in the short term.

The Relative Strength Index (RSI) and Stochastic Oscillator are both firmly in overbought territory, which usually means that short-term corrections are coming. Santiment, a crypto analytics platform, has warned investors about the high level of social media excitement about XMR. They pointed out that social dominance peaked on Sunday and development activity has been falling since early January.

The company told people who were thinking about buying to wait until FOMO and social frenzy died down before making new purchases. This is because the current excitement may have pushed prices too high to be sustainable.

Monero (XMR) Price Prediction: Key Levels to Watch

In the future, Monero will have to pass a big test at the $700 psychological barrier. A clear break above the $701 resistance level might start a rally toward the 100% Fibonacci extension goal at $741, which would be an extra 8% gain from where we are now.

However, if the expected decline happens, Monero might get a lot of support at the 23.6% Fibonacci retracement level near $600, which would be about a 12% drop from where it is now. This level is in line with previous consolidation zones and could be a good place for investors who missed the first rally to get in.

As long as regulatory pressures are driving demand for privacy solutions, the medium-term picture stays positive. But traders should keep an eye out for signs of tiredness in the present rise, especially as prices are going up while development activity is going down.

With the EU’s ban on privacy coins coming up in 2027 and worldwide monitoring getting worse, Monero looks like it will stay at the top of the privacy market. Still, short-term price swings and possible corrections are likely to happen as the market processes recent gains and reevaluates valuation levels in a technical situation that is becoming more and more overbought.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM