Pumpfun Moves 480M USDC as Price Drops 40%: New On-Chain Data Raises Alarms

Fresh on-chain analytics have intensified scrutiny around Pumpfun after blockchain monitors reported substantial...

Quick overview

- Pumpfun has transferred a total of 480 million USDC to exchanges, with 75 million USDC sent to Kraken in a recent transaction.

- The company faces scrutiny as analysts express concerns over large-scale treasury movements and their implications for liquidity and investor confidence.

- PUMP has experienced a 40% decline in value over the past month, alongside a significant 72% drop in revenue since January.

- Despite recent institutional interest, the token's performance continues to be overshadowed by aggressive sell-offs and declining user engagement.

Fresh on-chain analytics have intensified scrutiny around Pumpfun after blockchain monitors reported substantial movements of its ICO-linked USDC reserves. Data from EmberCN shows that the platform shifted 75 million USDC to Kraken within eight hours, raising the total transferred to 480 million USDC.

Although the company insists these transactions are part of routine treasury operations, the pattern has alarmed analysts. Kraken forwarded 69.26 million USDC to Circle soon after receiving the funds — a step commonly associated with liquidation rather than storage or internal consolidation.

Industry observers note that this is not an isolated event. According to Lookonchain, Pumpfun-related wallets executed $757 million in SOL sales between May 2024 and August 2025, suggesting long-running liquidity extraction rather than seasonal adjustments.

Key facts emerging from chain data include:

- 480M USDC transferred to exchanges to date

- 75M USDC sent to Kraken in the latest batch

- 69.26M USDC forwarded to Circle, likely signaling conversion

- $757M in SOL sold by associated wallets over 15 months

Co-founder Sapijiju has rejected the allegations, arguing that critics are misreading standard treasury management. Still, analysts warn that consistent high-volume outflows risk undermining confidence in the company’s buyback program, launched in September to support PUMP’s liquidity.

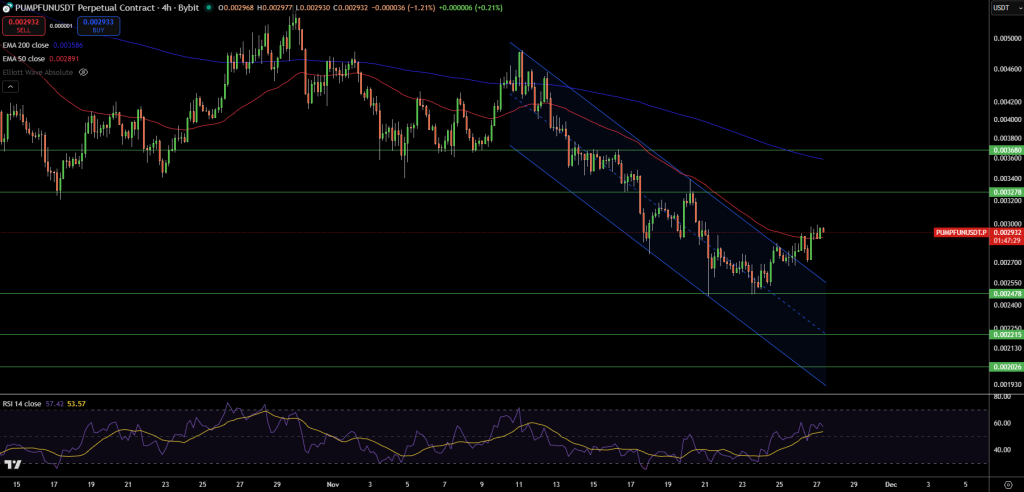

PUMP’s Slide Deepens

Despite internal restructuring and ecosystem upgrades, PUMP continues to lose value. After reaching a post-ICO peak of $0.00898 in August, the token has fallen to $0.00291, marking a 40% decline in the last month alone.

The downturn comes alongside a sharp contraction in platform revenue. Pumpfun reported $136 million in revenue in January, but that figure has dropped to $38 million, signaling weaker user engagement and reduced transaction volume.

Recent institutional participation — including Fitell Corporation’s decision to add PUMP to its treasury — has not reversed the trend. Analysts say the token’s chart remains dominated by downward momentum, overshadowing structural upgrades introduced in the Project Ascend initiative, such as tiered fee reductions and expanded creator incentives.

Revenue Pressures Reshape Outlook

The combination of declining revenue, aggressive token sales, and substantial USDC outflows is reshaping market sentiment. While Pumpfun maintains that its treasury behavior is routine, investor confidence appears increasingly strained.

Bullet-point summary of current pressure points:

- Sharp 40% monthly decline in PUMP

- 72% revenue drop since January

- Large-scale treasury movements fueling sell-off speculation

- Buyback program struggling to stabilize liquidity

For now, Pumpfun faces a market demanding transparency — and data showing a widening disconnect between ecosystem upgrades and token performance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM