Bitcoin Holds $87,000 as $30 Billion Options Expiry Looms: Break Above $94,000 or Further Consolidation?

Bitcoin is steady over $87,000 as traders get ready for the important end-of-year options expiration that could set the market's course

Quick overview

- Bitcoin is currently steady above $87,000 as traders prepare for a significant $30.3 billion options expiration that could influence market direction into 2026.

- Bearish sentiment dominates the options market, with most call options set to expire worthless, indicating a potential struggle for Bitcoin to maintain upward momentum.

- Technical analysis suggests that $94,000 is a critical threshold for Bitcoin's future, with various scenarios predicting either a rise or a continued decline in the coming months.

- Despite near-term uncertainties, bullish catalysts remain, including institutional accumulation and potential stimulus measures that could support Bitcoin's long-term value.

Bitcoin BTC/USD is steady over $87,000 as traders get ready for the important end-of-year options expiration that could set the market’s course until the first quarter of 2026.

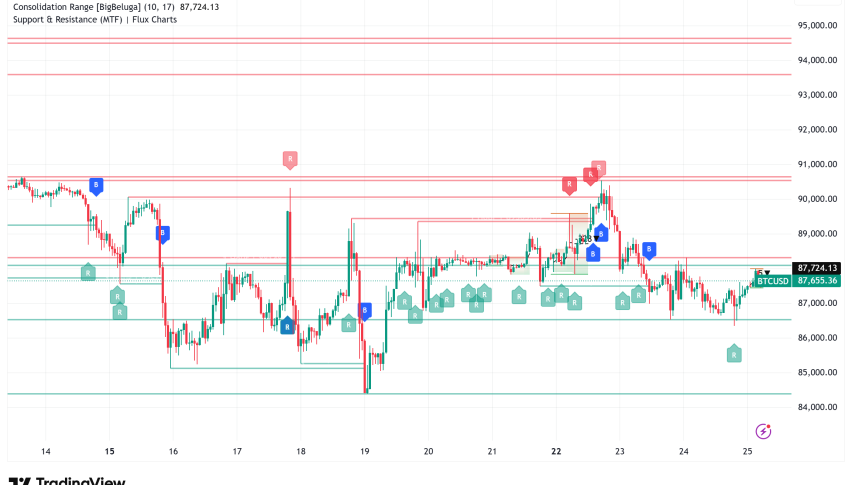

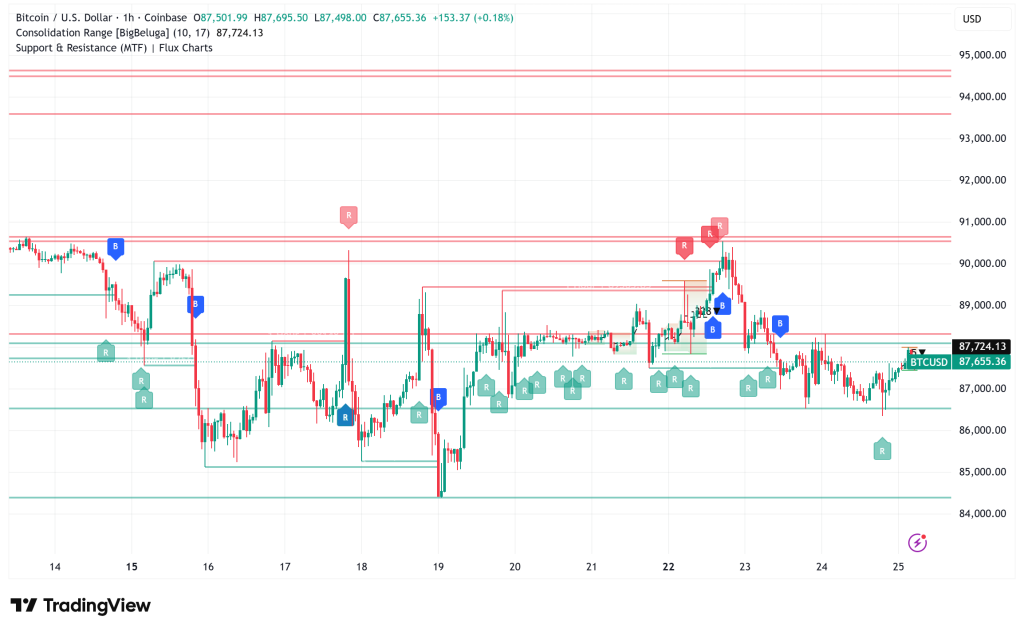

Bitcoin is still trading in its usual range around $87,350 as of this writing, and it has stayed above the psychologically key $87,000 barrier for five weeks of consolidation. The biggest test of the year for the leading cryptocurrency is coming up on Friday at 8:00 AM UTC, when a huge $30.3 billion options expiration will happen. This event might decide whether bulls or bears rule the market going into 2026.

Bearish Options Positioning Dominates Despite Institutional Optimism

The options that expire at the end of the year show that the market is leaning toward pessimistic sentiment, since most call options are substantially above the current trading ranges. According to Deribit, which has 80% of the total open interest, most of the $21.7 billion in call options will expire worthless. Less than 6% of Deribit’s call options are at $92,000 or less, and most of them are between $100,000 and $125,000.

Market players seem to have been surprised when Bitcoin fell below the important $100,000 psychological support level in November. The cryptocurrency hit an all-time high of almost $126,000 earlier this quarter, but then it dropped sharply by 29% and has been stuck between $85,000 and $90,000 for the rest of December.

But bearish methods might have gone too far by putting together wagers between $75,000 and $86,000. If Bitcoin trades above $88,000 on Friday, more than half of the $7.7 billion in put options on Deribit will expire worthless. This could cause a short squeeze.

$94,000: The Critical Threshold for Market Direction

Technical analysis says that $94,000 is the key mark that will decide where Bitcoin goes in the new year. Options data shows four likely outcomes for the Friday expiration:

- $86,000 to $90,000: The net outcome is in favor pushed instruments up by $2.4 billion

- $90,001 to $94,000: The end outcome is good for put instruments by $1.5 billion $94,001 to $96,000: The net result is that put instruments are worth $650 million more.

- $96,001 to $98,000: There is a balance between calls and puts.

If Bitcoin prices drop below $90,000 on Friday, it would be very bad for bulls. Prices below $94,000 are still good for bearish options strategies. However, the way derivatives work suggests that the more likely outcome is an upward movement toward the mid-$90,000s rather than a long-term drop below $85,000.

The present consolidation has been caused by dealer hedging due to a lot of options exposure. They buy dips at $85,000 and sell rallies near $90,000. As gamma and delta decay, this stabilizing impact gets weaker. With $27 billion worth of options about to expire, prices may be able to move more in either direction.

BTC/USD Technical Patterns Point to Q1 2026 as Decisive Period

Despite December’s poor performance, which analysts have called “very boring” because there were no huge stories or moves, technical patterns predict that Q1 2026 will be the time when Bitcoin either proves itself or confirms that the cycle is over.

Market observers have come up with two different scenarios. The first one says that Bitcoin might be following its 2021-2022 fractal, which would mean that it would briefly rise again to $100,000 at the beginning of 2026 before continuing to fall toward the $60,000-$70,000 range. This negative scenario fits with historical cycle analysis that says Bitcoin might hit a bottom around October 2026, which is the usual 364-day corrective window after significant tops.

The most positive scenario shows that Bitcoin is forming a multi-month falling wedge pattern on the three-day chart, like the one that formed between Q4 2024 and Q2 2025 and caused the Q3 2025 rally. If history repeats itself, the cryptocurrency might test the lower border of the pattern again in the next few weeks before bursting out and possibly reaching new highs by the second quarter of 2026.

Bullish Catalysts Remain Despite Near-Term Uncertainty

Even though options markets are being cautious, there are still a number of optimistic factors that point to a positive long-term future for Bitcoin. After Treasury Secretary Scott Bessent said that the U.S. would give a $2,000 tariff rebate to people who aren’t wealthy in early 2026, investors are betting that stimulus measures will happen more often. President Donald Trump has also said that whoever takes over as Fed Chair Jerome Powell in May should make decreasing interest rates a top priority.

Over the past week, Bitcoin traders have responded by raising their year-end call option holdings in the $90,000 to $120,000 region. This shows that they are still hopeful, even if they have tried and failed numerous times to get back to $94,000. Institutional accumulation is still going on, and corporate purchases worth billions are the main reason people are starting to trust BTC again as a store of value.

Bitcoin Price Predictions: From $100,000 to $1 Million by 2030

If macro conditions are stable, short-term price prediction models say there is a chance for a 20–30% increase, with a target of about $100,000–$110,000 by the end of December 2025. If the overall market structure stabilizes and demand from long-term investors stays consistent, some analysts think Bitcoin might hit $108,000 to $115,000 by January 2026.

The Relative Strength Index is currently near neutral levels, and Bitcoin is trading below its 50-day and 200-day moving averages. The Moving Average Convergence Divergence (MACD) on multi-day timescales is close to a possible bullish crossover. This would favor a steady rebound instead of a further fall.

Bitcoin price prediction models for 2030 range from conservative projections of $163,000 to aggressive aims of $1 million. Notable analysts like Cathie Wood still believe in her $1 million target, which is supported by limited supply and expanding use as digital collateral.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM