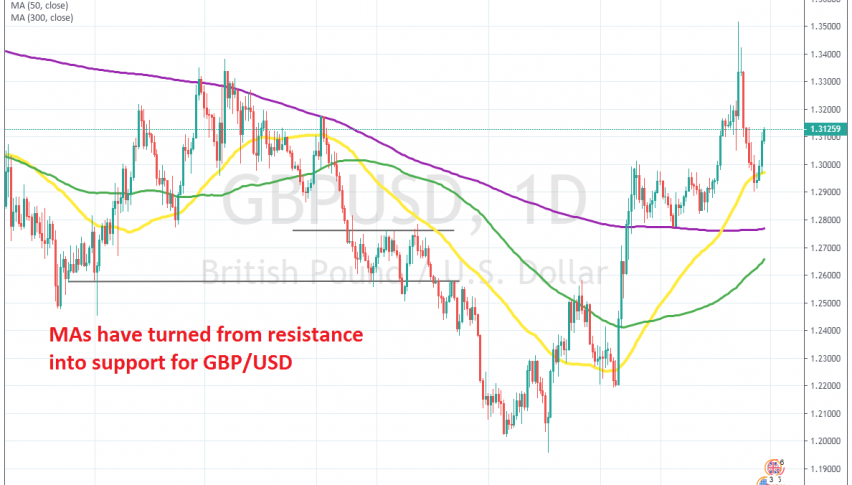

GBP/USD Turns Bullish Again at the 50 Daily SMA

GBP/USD has turned bullish again, after forming a small doji and finding support at 1.29

[[GBP/USD]] surged around 8 cents when the general elections were announced in the UK in October. Then we saw a second surge of more than 500 pips after Boris Johnson’s Conservatives won a comfortable majority in the UK Parliament earlier this month.

The political scene became more simple in UK, now that Tories have all votes they need to take the UK out of the EU. But, after the last surge, following UK elections, the optimism faded, since it will still be difficult for the UK to reach a trade deal with the EU, which would mean hard Brexit.

So, the Pound turned bearish in the following week and GBP/USD lost more than 6 cents, falling below 1.30. Although, the price reversed at 1.29, after forming a small doji candlestick. This pair has been pretty bullish in the last three days, so buyers are back in control now. Moving averages have turned into support now, with the 200 SMA (purple) providing support during October and November, while now, it’s the 50 SMA which is doing that job on the daily chart.

Although, I don’t expect this to last long, because the latest bullish move is due to some USD weakness. The GBP on the other hand, doesn’t have many reasons to be bullish right now, so I expect a reversal when this phase of USD weakness is over. When will it be? Perhaps at 1.32, or 1.35, who knows?

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM