Ethereum Historical Price Charts – ETH Price History

Last Update: March 28th, 2023

Ethereum is a blockchain specifically used for smart contract execution, autonomous organizations, and decentralized apps. Everyone has open access to digital money and data-friendly services through Ethereum. It is a community-built technology behind thousands of applications and the cryptocurrency Ether (ETH). Ether is also known as “token” because to execute a smart contract or transaction using the Ethereum blockchain, one must include enough ‘gas’ or ether to run the program. It means ether is a price one must pay to program code on the Ethereum blockchain.

Ethereum was invented by Vitalik Buterin, who was just an 18-year-old teenager in 2013. His idea was cheered by the global blockchain community, and after that, a British computer programmer, Gavin Wood, proved that the system invented by Buterin was possible to create. Together, they became the first members of the Ethereum team and raised $ 18 million for the project’s development. On 30th July 2015, they launched the first version of the Ethereum cryptocurrency platform, called Frontier. On 7th August 2015, the Ether (ETH) was added to the Kraken crypto exchange at $2.77 per coin, this is according to the Ethereum price history. In 2019, DeFi became the largest sector within Ethereum as activity in the decentralized finance market, and gaming increased significantly. On 4th August 2020, Ethereum launched the final Ethereum 2.0 testnet that made the network faster, cheaper, and more scalable, marking a significant moment in the Ethereum price history.

Current ETH/USD Price: $

Factors affecting ETH/USD

Mining Profitability:

The mining profitability has a significant impact on Ether prices. The mining profitability is relatively high when the ETH price is between $300 and $400. Miners tend to sell their coins at a better price when the profitability is high. If the profitability becomes low after many people start mining, other miners will hold on to the coins to wait to sell until prices become more favorable. It means the nature of mining tends to fluctuate the prices of ETH/USD.

Recent Trends:

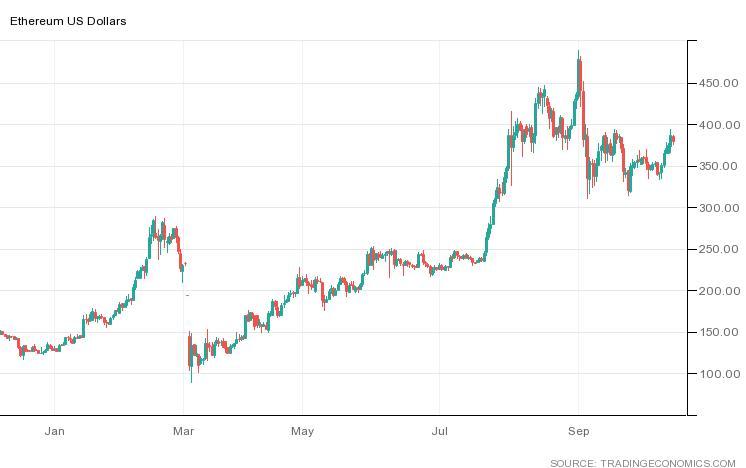

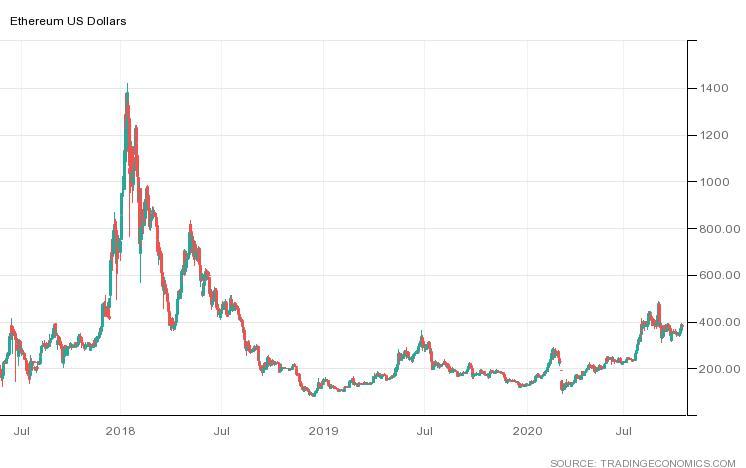

According to Ethereum price chart history, Ethereum became the world’s second most popular cryptocurrency on the market when the Ethereum blockchain’s popularity exploded. The price of ETH reached to $1400 in January 2018 due to its increased popularity of it. However, eventually, prices dropped, and since then, it stayed above $300. In the cryptocurrency market, the recent trends related to specific cryptocurrencies can greatly influence its prices especially granted the Ethereum historical price.

Regulations:

Since many cryptocurrency transactions are cross-border transactions, they are highly influenced by the changed regulations in any country. So, whenever the word’ regulation’ comes around in the cryptocurrency market, it negatively affects cryptocurrencies’ prices. In September 2017, China banned ICOs and crypto trading that quickly slashed ETH prices to nearly $220 from $400.

After that, South Korea’s threats with the regulations also led to a significant decline in the investment inflow. However, if a country changes regulations to embrace the cryptocurrency market, it would positively impact ETH prices.

Cryptocurrency Exchanges:

Cryptocurrency exchanges do not have the necessary infrastructure to handle the rapid growth of cryptocurrencies like Ethereum as they are relatively new. Some exchanges offer limited accounts, and some have even stopped accepting new accounts as they are improving their support options. Security breaches and software updates affect cryptocurrency exchanges, and these can influence the prices of cryptocurrencies.

Adoption:

Whenever Ethereum gains popularity and a major corporation adopts it, the prices of Ethereum increases. It is because the adoption of Ethereum reflects the increased demand for the coins. It is technical that when more people adopt the currency, the prices go up, especially when there is a large arrival of the new user.

Future Potential:

Many people use Ethereum because the future potential of Ethereum is very stable. It is a platform that has thousands of applications to a wide variety of people. Tech companies rapidly incorporate smart contracts, blockchains, and automation into their day to day operations, and Ethereum provides a platform for this purpose. Many companies that utilize smart contracts are emerging in the market that has increased the price of Ethereum.