Late U.S. Session Energy Outlook-Inventories On The Horizon

Today’s energy trade has been relatively quiet as this week’s inventory cycle draws near. WTI crude oil has entered a prolonged consolidation phase, rotating between $51.00 and $52.75. Consolidating markets can be tough to trade, often producing whipsaw price action on the intraday timeframes.

Below are the release times for this week’s inventory reports:

Today: API crude oil stocks, 4:30 PM EST

Wednesday: EIA crude oil stocks, 10:30 AM EST

Thursday: EIA natural gas storage, 10:30 AM EST

Be sure to keep a close eye on your risk management around these times of increased volatility.

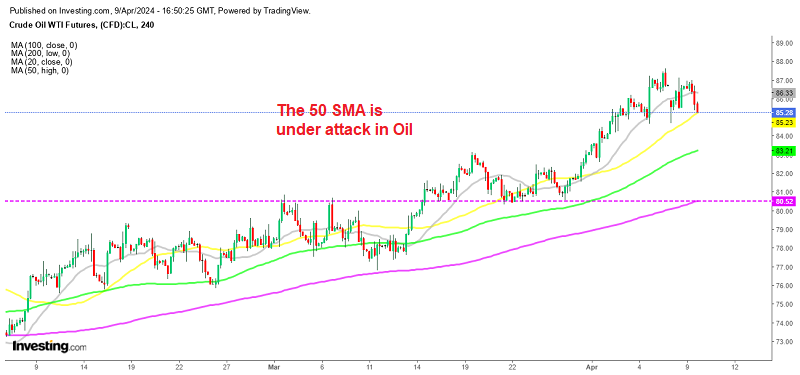

WTI Crude Oil Technical Outlook

December WTI crude oil futures are trading near $52.50, up 57 cents for the session. As of now, crude does not seem to have a direction.

December WTI Crude Oil Futures, Daily Chart

December WTI Crude Oil Futures, Daily Chart

No doubt about it, this market is in full rotation. Here are a few key levels to be aware of:

Last week’s high of $52.65 is serving as primary topside resistance.

September’s high of $53.11 stands as secondary resistance.

A crossover of the Bollinger MP and Daily SMA signals a change in market sentiment.

Overview: Trading rotation requires exceptional patience and great timing. For now, I will be waiting for a test of the Bollinger MP or Daily SMA to generate a long entry in the coming days.

Natural Gas Technicals

Well, here is our first look at the December Henry Hub natural gas futures contract.

December Natural Gas Futures, Daily Chart

December Natural Gas Futures, Daily Chart

December natural gas futures are trading with split volumes pending full rollover. Active trading of futures contracts during rollover can pose many challenges. It is crucial to respect the impact that institutional money can have on these markets. Aggressive risk management is a must!

Here are the key technicals for this market:

Support level 1, Bollinger MP: 3.134

Support level 2, Daily SMA: 3.122

Resistance 1, 50% Retracement: 3.183

Again, we are seeing an MP/SMA moving average crossover on the daily timeframe for natural gas. This is not a clear-cut signal of shifting sentiment, in that rollover is influencing intraday price action.

Overview: Today’s closing range will be the catalyst for trade later in the week. It looks as though we may settle into rotation between topside resistance and the support levels. That is fine by me, as we will be able to craft an affordable trading plan to fade the extremes back to value.

Natural gas is a great compliment to WTI crude oil. Stay tuned for future trade recommendations and analysis facing this exciting asset.

++10_24_2017.jpg) December WTI Crude Oil Futures, Daily Chart

December WTI Crude Oil Futures, Daily Chart++10_24_2017.jpg) December Natural Gas Futures, Daily Chart

December Natural Gas Futures, Daily Chart