Things To Watch In The US Session – BOC Ready to Role

It has been a volatile day so far, especially after the release of the UK inflation figures. During the New York session, we can expect some nice opportunities in the Gold, Loonie and Crude Oil.

Gold – Violating the Gartley Pattern

As I mentioned in my earlier update Gold Soars as Bullish Gartley Pattern Under Way, the metal has already violated the pattern and is heading north to $1,356. I will be looking to stay bullish above $1,348 and bearish below $1,356 during the US session.

GBP/JPY – Signal Performs Well

Our forex trading signal on GBP/JPY is performing really well, trading just inches away from the take profit level of 152.60. Being rational traders, we should move our stops at even. Keep following for the next entry.

WTI Crude Oil – Crude Oil Inventories Ahead

The Crude Oil is trading strongly bullish and testing a solid resistance level of $67.65. Looks like investors are pricing in an expectation of -0.5M draw in inventories. EIA will be releasing the figures at 14:30 (GMT). If the EIA reports a build in inventories, we could see a massive drop in Crude Oil. I’m keeping an eye on $67.75, below this, we can expect a retracement up to $67 and $66.50.

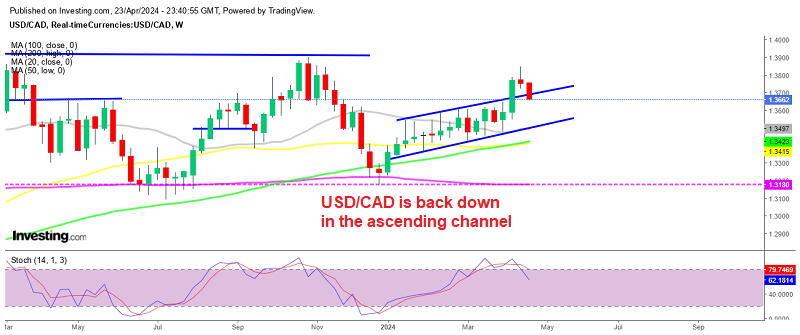

BOC Monetary Policy

The BOC (Bank of Canada) Monetary policy is due in an hour and a half. As discussed in April 18 – Economic Event Outlook, the BOC is expected to keep the rates on hold. Yet, we should be ready for any surprise from the BOC.

Good luck and trade with care!