Everything you need to know about U.S.- China Trade War

You’ve probably heard how the US- China trade war tensions are ruling the global financial markets. Over the past two weeks, it has changed the correlation among the trading instruments. It’s important that you learn what’s the trade war and how it impacts global stock markets, bullion and forex. After you read this article, you will be able to understand what’s going on in the market and what’s on the cards…

What’s the Trade War?

As per Wikipedia, ‘‘A trade war is an economic conflict resulting from extreme protectionism in which states raise or create tariffs or other trade barriers against each other in response to trade barriers created by the other party.”

In simple words, the trade war is a scenario in which countries counter against a country that inflicts trade barriers such as tariffs and quotas. It escalates global tensions when economies or countries kick off tit-for-tat responses. That’s something going on between the U.S. and China right now.

Why would Trump do that?

Do you know about Balance of Trade? Well, it’s a difference between the value of goods exported and imported. Countries exports are like its sales, while imports are purchases.

What happens when your purchases are higher than your sales?

You will probably be in deficit and someday will end up spending all your savings. However on the country level, when your exports are lesser than your imports, it’s called trade deficit which hurts your local industry. This simply means that your people are buying products from other countries, which hurt the local manufacturers.

Back in 2017, the U.S. trade deficit soared to $566 billion. It imported $2.895 trillion of goods and services while exporting $2.329 trillion. One of the reasons is that the dollar rallied around 28% between 2014 and 2016, making the imports cheaper for the U.S. people. Conversely, it made the U.S. products expensive for other countries.

Therefore, President Trump wanted to conquer these deficits with protectionist measures. In case you are wondering what are the protectionist measures, it’s a type of strategy that limits improper competition from foreign industries.

For instance, these measures can be:

- Imposing tariffs on imported goods

- Subsidizing local industries

- Imposing quotas on imported goods

- Devaluation of currency

Out of these four, Trump decided to go with imposing tariffs on imported goods – the first in the list. Here’s how the trade war sentiments began…

U.S. – China Trade War – The War of Words

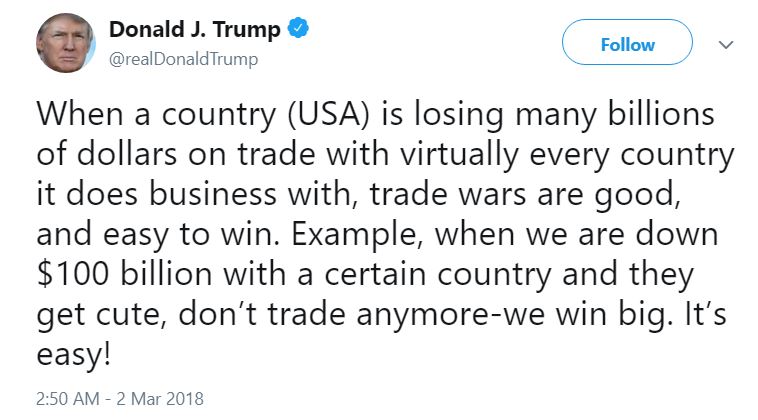

Back in March 2018, Trump tweeted that “when a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win.”

So, Trump inflicted aluminum and steel tariffs in order to protect American industries. He declared 25% tariffs on $50 billion to $60 billion in Chinese exports to the U.S., including aerospace, information and communication technology, and machinery. The first wave of tariffs to include $34 billion of goods will take effect on July 6. It’s a way to limit the Chinese exports to the U.S. which will hurt the Chinese economy.

I’m not sure if Trump expected this or not but the world’s second-largest economy China slapped back with a $50 billion list of U.S. goods, including soybeans and aircraft, that it intends to cover with plausible tariff hikes.

- Now that’s when things became childish. Trump then pledged tariffs on roughly 1.3K Chinese products.

- Just hours later, China hit back with a further $3 billion in tariffs against 128 U.S. products.

- In response to that, the POTUS was entertaining the idea of another $100 billion in tariffs.

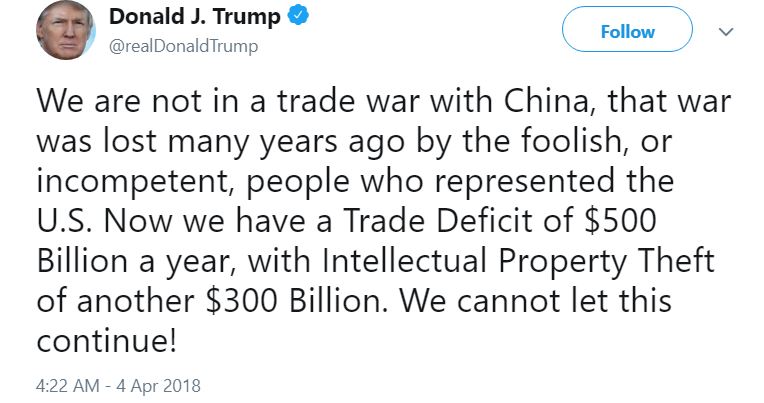

It clearly sounds like a trade war. But then Trump tweeted:

Trade War – How It’s Impacting the Financial Markets?

Headlines of U.S. tariff decisions promptly spooked stocks. Since then, the global stock markets are trading in a bearish tone. It’s because of the uncertainty in the market.

The point is, the series of tariffs on aluminum and steel are likely to limit the supplies for the U.S. companies. But who guarantees that the U.S. steel and aluminum companies will be able to meet local demand from bigger companies like Ford Motors and Boeing? Probably these companies will be forced to buy raw materials at a higher cost because they simply can’t give up their businesses.

It gonna impact the U.S. markets in two ways:

1- Higher cost of raw material will be transferred to the U.S. consumers which may trigger hyperinflation.

2- Higher cost of goods sold will cut the companies’ profits, which may cause a drop in EPS (earnings per share). Would you like to invest in or hold stocks for a company whose EPS is expected to fall? You don’t need to answer. I know it’s a big NO.

3- Thirdly, companies may try to cut their expenses. In order to do so, the most common strategy is downsizing. But this will cause a jump in the unemployment rate and higher rate of unemployment is a root of economic and financial crises. So, would you invest in an economy whose economic indicators are missing expectations?

By now, it should be clear to you that the trade war isn’t a solution to anything but can cause further problems. Therefore, the stock markets are facing an immense amount of selling pressure, boosting the demand for safe-haven assets. The most common safe-haven assets are bullion (Gold & Silver), Japanese Yen and Swiss Franc.

But wait, if gold is a safe haven asset then why is it trading bearish despite a sharp sell-off in the global indices like SPX, DAX, and DOW?

Typically, a robust buck makes dollar-denominated gold expensive for non-U.S. traders and while sinking equities, perceived as risky assets, usually help safe-haven gold, they have disappointed to do so this time.

Interestingly, the market correlations have changed for the time being. Gold tumbled to its lowest level in more than six months despite the safe-haven demand. That’s because of the rise in Fed fund rate from 1.75% to 2% and expectations that there will be two more rate hikes.

What’s Next on China – U.S. Trade War?

The trade war begins on July 6 and the clock is ticking towards it. That’s when the POTUS said he will impose 25% tariffs on $34 billion worth of Chinese imports. Brace yourself for a sell-off in the global stocks and dollar. While bullion (gold and silver) is likely to remain supported or may get bullish moves on safe-haven concerns.