The EUR/USD has been struggling along over the last week and as it stands, has not been able to hang onto the 1.17 handle as yet.

As we look to the week ahead, there is a heap of data out, however, it appears it’s the USD that will again be the focus.

After Mario Draghi again came out and disappointed EUR/USD traders, it’s now over to Jerome Powell and the FOMC to try and spark the USD. No one is expecting a rate hike at this meeting, however, we will be interested if there is any more guidance ahead.

The biggest data point for the EUR this week is CPI. Weak inflation has been a real problem for the Eurozone for many years, however we are inching towards the bottom end of what the ECB might see as an acceptable target at 2%.

The other headline act is also US jobs on Friday. This number has the opportunity to spark the USD or send it tumbling. If I were a betting man I’d be looking for a good result, keeping with what we’ve been seeing recently out of the US.

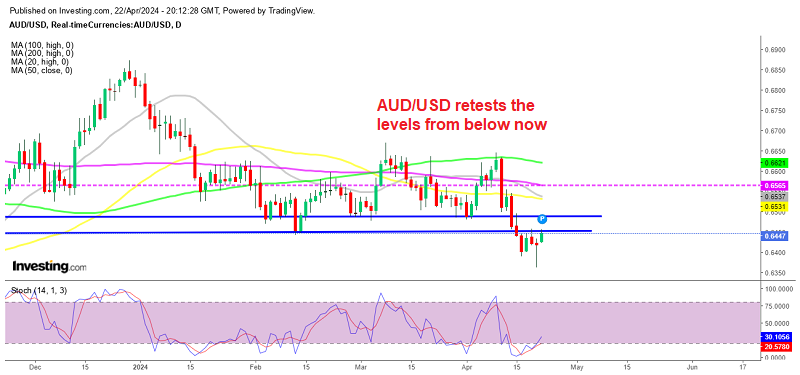

Technical Outlook for the EUR/USD

The EUR/USD has been battling to poke its head above the 1.1750 mark and has fallen back below 1.1700. In reality, we are just rotating around 1.1700.

A decent strategy at the moment is simply to fade the spikes in both directions.

1.1750 seems like a pretty clear resistance level and it’s a good point to be fading. Especially given we have a bullish USD. But just be aware that we really haven’t ticked as high as 1.1750, so we need to be looking for some weak candles as we approach that level again.

I’d be looking for the same type of price action this time on a break of 1.1600.

However, to be clear, I’m bearish on the EUR/USD given the rally we’ve had in the Greenback, so I’m far more interested in being short where I can.