Japan’s Manufacturing Sector Seen Contracting for Eighth Straight Month in December

In a worrying sign for the economy, factory activity in Japan continued to remain in contraction for the eighth consecutive month during December. The Jibun Bank Flash Manufacturing PMI declined to 48.8 in December from the final reading of 48.9 for November.

While these are the preliminary readings for the PMI figure, in case the final reading comes in lower than that of November, it will mark the longest stretch of contraction in the Japanese manufacturing sector since February 2013. This sector has been under severe strain on the back of the prolonged US-China trade war and China is one of Japan’s key trading partners.

The manufacturing sector in Japan remains in contraction as a result of a continued reduction in key output and new orders received since the beginning of 2019. New export orders declined for the 13th straight month in December, but on the positive side, the rate of decline was the slowest seen in a year.

Further disappointing economic data was released following a BOJ survey of Japanese companies’ expectations for inflation. According to the survey, Japanese firms anticipate consumer price inflation to touch 0.8% YoY, lesser than their 0.9% forecast from the previous quarter.

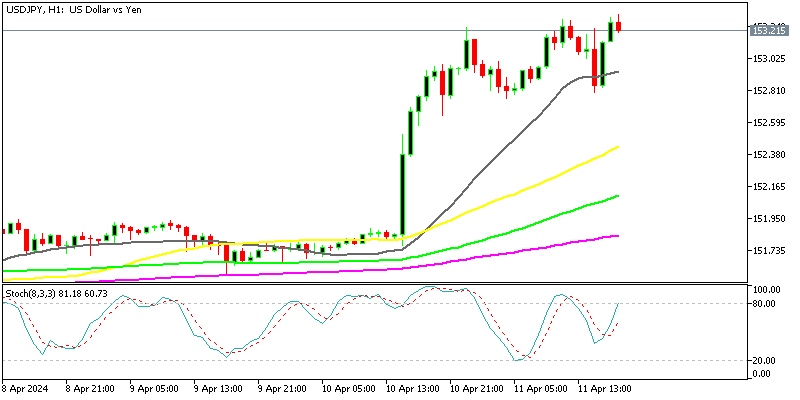

Following the release of this, the Japanese yen continues to trade steady, seemingly unaffected. At the time of writing, USD/JPY is trading at around 109.37.