⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

GBP/USD Can’t Keep Gains, Despite Inflation Jumping Higher in January

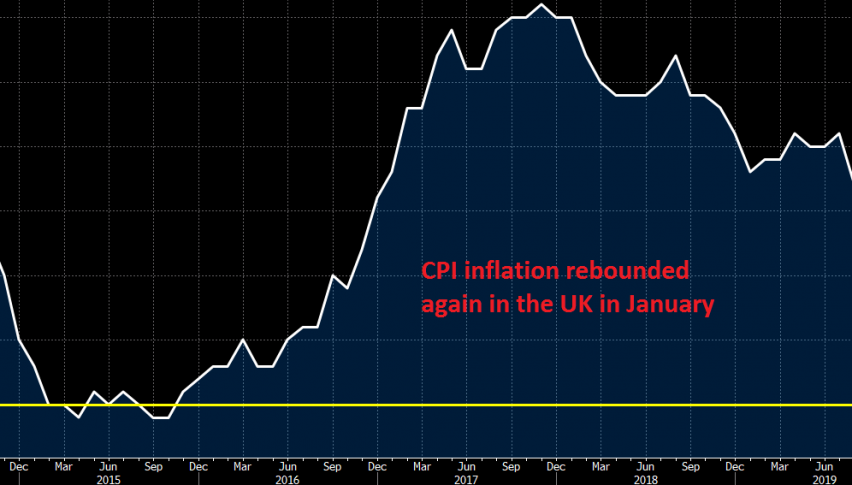

Inflation was holding up well in Britain during the last two years, despite the weakening global and the UK economy, as well as inflation cooling off considerably in other areas of the world, such as the Eurozone. But, it started cooling of in the UK as well towards the end of 2019.

In December, CPI (consumer price index) inflation fell to 1.3%, which got the Bank of England worried. They turned dovish as a result last month, but today’s report which is for January is showing a decent improvement, which sent GBP/USD jumping higher, but it has given back those gains now. Below is the inflation report from the UK:

- UK January CPI +1.8% vs +1.6% y/y expected

- Prior +1.3%

- CPI -0.3% vs -0.4% m/m expected

- Prior 0.0%

- Core CPI +1.6% vs +1.5% y/y expected

- Prior +1.4%

You can see that there is a decent improvement in both the headline and core figures, and that should provide some encouragement to the BOE that they aren’t quite at risk of falling into the low inflation trap just yet – for now at least.

Looking into the details, the rise in inflation is due to higher petrol prices and airfares falling less than a year ago, with annual house prices also growing across all regions in the UK for the first time in nearly two years. That should keep the BOE sidelined for now but it doesn’t really change the overall picture too much. The pound is off lows of around 1.2985-95 to 1.3000-05 currently but I don’t see this as a major catalyst for a push higher.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments