GOLD has been bullish for more than a year now, but the uptrend picked up considerable pace since the last week of February, when coronavirus spread in Italy. That panicked everyone and the panic continues, sending Gold surging higher, as safe havens do in such times.

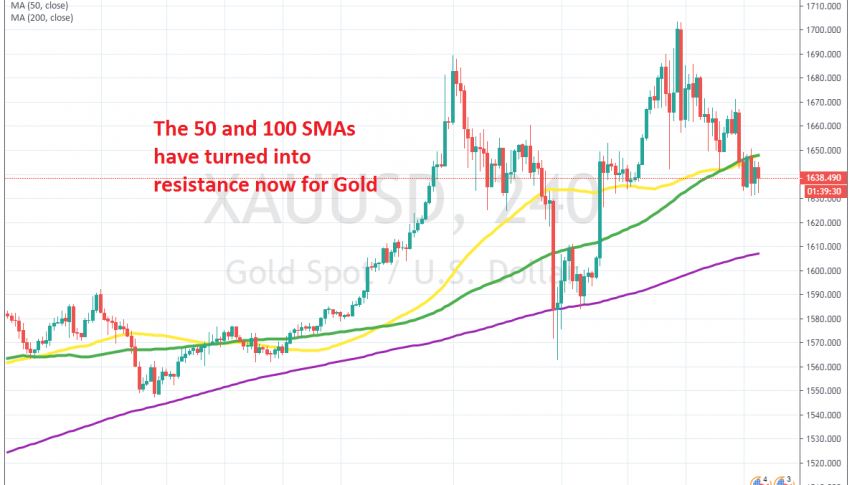

Gold broke above $1,700 early this week, after Oil prices had crashed over the weekend. But, it retraced back down as the panic wore off a bit. During the bullish move, Gold has been finding support at moving averages on different time-frames and on the H4 chart it has been the 50 SMA (yellow) and 100 SMA (green).

But those moving averages have now been broken. Now these two moving averages have turned into resistance. The price has been trading below these two moving averages since yesterday evening, but it is not falling far from them. So, it seems like traders are waiting for a reason to turn bullish again. But, that will come when Gold moved back above these two MAs again.