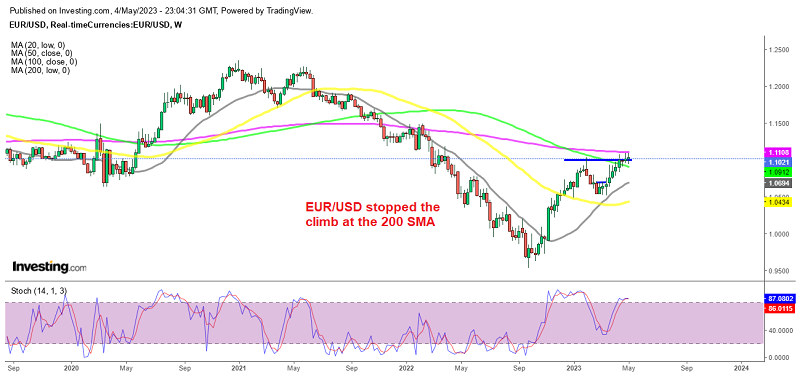

ECB Leaves EUR/USD With A Bearish Reversing Chart Setup

On a Friday, there was quite some market turbulence for the Euro, after the European Central Bank’s (ECB) meeting. Before the ECB meeting, there were some speculations that they could raise the refinancing rate by 50 bps, but they ended up opting for a 25 bpshike instead, a reduction in the asset purchase program reinvestment in July, and some indication of further increases in the future, with some members seeing 2–3 more hikes ahead.

This should have been bullish for the Euro, but the market reacted negatively to the decision, interpreting it as dovish. During the press conference, there was some volatility as ECB President Lagarde made some hawkish remarks as well. However, ultimately the market sees the ECB as running out of time for further rate hikes, leading to a decline in the Euro across the board.

Holzmann, who didn’t have a vote at the meeting, was the lone holdout, while policymakers reached deal on smaller hike in return for guidance for more hikes ahead and an APP wind down. So, it seems like markets weren’t satisfied with this and turned bearish on the Euro.

Press Conference from the ECB President Christine Lagarde

- The inflation outlook continues to be too high and too long

- Incoming information broadly supports medium-term outlook that we formed at our previous meeting

- We will continue to follow a data-dependent approach

- Private domestic demand, especially consumption, is likely to remain weak

- Business and consumer confidence have improved but are lower than in pre-war

- The manufacturing sector is working through a backlog of orders but prospects worsening

- Government should roll back energy support measures promptly as the energy crisis fades

- Price pressures remain strong

- Inflation is still being pushed up but the gradual pass through of previous energy price rises

- Lagarde no longer says growth risks are to the downside

- We are not pausing, that’s very clear

- We know that we have more ground to cover

- 25 bps hike had almost unanimous support

- All governors determined to tame inflation

- Mood was very focused and attentive to all data

- We have covered a lot of ground… we are continuing this hiking process

- This is a journey, we have not arrived yet

- Some governors suggested 50 bps was appropriate, some said 25 bps but none said no change

- There was a very strong consensus around the path we chose

- Reports from corporates regarding borrowing suggest to us that rates are restrictive

The market is pricing in 43 bps of hiking in September and then coming down afterward.