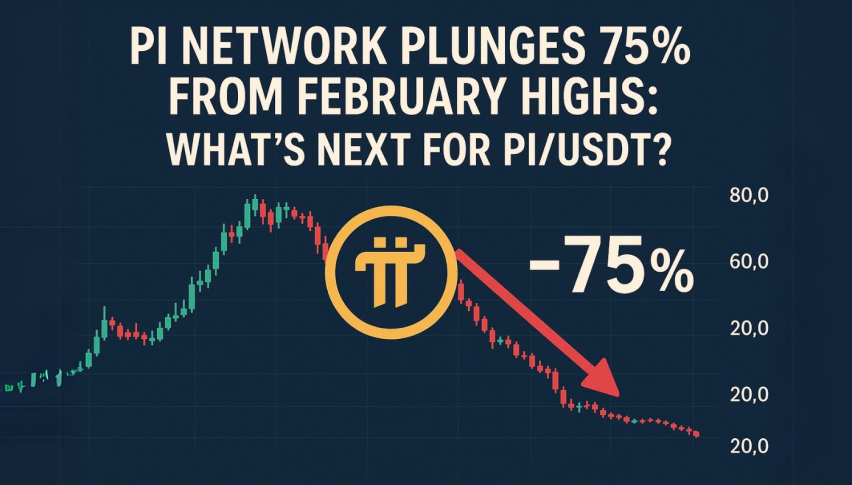

Pi Network Plunges 75% from February Highs: What’s Next for PI/USDT?

The Pi Network token (PI/USDT) has faced an unrelenting downtrend, shedding over 75% of its value since peaking near $3 in February.

Quick overview

- The Pi Network token (PI/USDT) has dropped over 75% in value since its February peak, currently trading around $0.6793.

- Despite a recent surge in trading volume, sell pressure is rising due to increased exchange inflows and an upcoming supply boost from token unlocks.

- Technical indicators confirm a bearish trend, with key resistance at $0.7266 and support levels at $0.6552, $0.6052, and $0.5536.

- The Pi Network is pursuing growth through a $100 million fund aimed at expanding use cases, but price recovery remains uncertain without tangible adoption.

The Pi Network token (PI/USDT) has faced an unrelenting downtrend, shedding over 75% of its value since peaking near $3 in February. After briefly surging 200% to $1.67 in early May, PI has entered a steep decline, currently hovering around $0.6793. The recent breakdown below the 50-period EMA at $0.7266 underscores persistent bearish sentiment, with price action confined to a descending channel pattern marked by lower highs and lower lows.

-

Key Support Levels: $0.6552, $0.6052, and $0.5536

-

Key Resistance Levels: $0.7266 (EMA), $0.7389, $0.7974

-

Trading Volume: Surged 42% to $158 million, hinting at active sell-side flows

Despite surging trading volume, the increase in exchange inflows signals rising sell pressure, compounded by an expected supply boost from over 600 million PI tokens unlocking between June and August. Until buyers reclaim levels above the descending channel and moving averages, the bearish trend is likely to continue.

Technical Indicators Confirm Downtrend Pressure

The technical landscape paints a clear picture of weakness for PI/USDT:

-

MACD: Histogram remains negative, though a slight bullish divergence hints at a possible pause in downside momentum.

-

Awesome Oscillator: Red bars dominate, confirming selling pressure.

-

RSI: Hovering near 43.6, suggesting weak bullish conviction.

-

Stochastic RSI: Deeply oversold at 2.77, but no clear reversal signals.

-

ADX: Near 29.9, indicating strong trend strength with potential exhaustion ahead.

Recent candlestick patterns show long wicks near $0.6793, indicating attempted buyer defenses, but lower highs and the descending channel highlight continued market hesitancy.

Growth Plans and Potential Rebound Triggers

While PI struggles on the charts, the project is pressing ahead with real-world initiatives. Pi Network’s recently launched $100 million Pi Network Ventures fund aims to invest in e-commerce, fintech, gaming, and AI sectors, a strategic move designed to expand use cases and drive demand for the token. However, until fundamentals translate into tangible adoption, price recovery remains elusive.

-

Unlock Schedule: 263 million PI in June, 233 million in July, 132 million in August

-

Long-Term Catalyst: Strategic $100 million fund to support tech and commerce innovation

-

Outlook: Technicals suggest a wait-and-see approach; a breakout above $0.7266 is needed to shift sentiment

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM