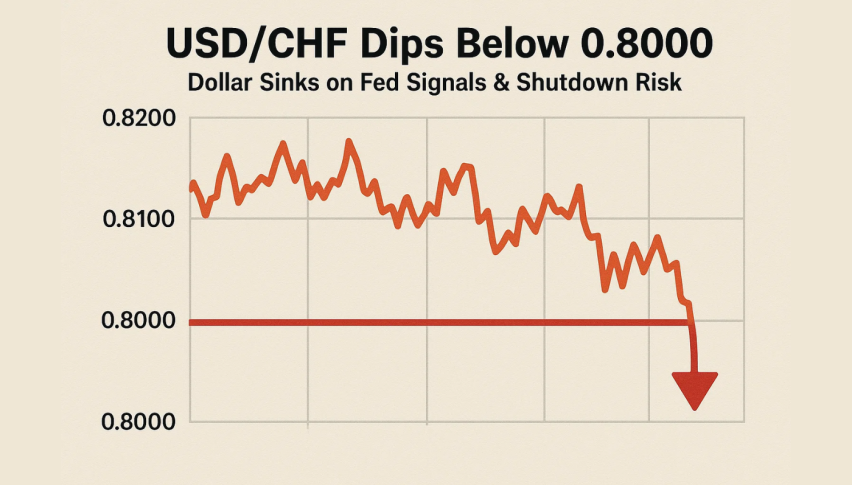

USD/CHF Dips Below 0.8000 as Dollar Sinks on Fed Signals & Shutdown Risk

USD/CHF slumped once again during the European session, slipping under 0.8000 and hitting a two week low because the dollar...

Quick overview

- USD/CHF has dropped below 0.8000, reaching a two-week low due to ongoing US political instability and trade tensions with China.

- The technical analysis shows USD/CHF is in a descending channel, struggling at key resistance levels around 0.7968.

- Traders are advised to wait for a price closure above 0.7985 for a potential long position, with targets set at 0.8008 and 0.8046.

- Current market sentiment is cautious, with traders uncertain about the next move as indicated by recent candlestick patterns.

USD/CHF slumped once again during the European session, slipping under 0.8000 and hitting a two week low because the dollar just isn’t doing well. We’re talking three weeks without a government in the US, and the dollar just isn’t being helped by all this. To make matters worse, the US-China trade tensions are flaring up again and now there’s talk the Federal Reserve might be less aggressive in raising interest rates – all of this is sending the dollar down.

You’ve got to hand it to the politicians in Washington – they’ve really managed to create a cloud of uncertainty. For the third time this month the Senate voted down a funding bill – and that’s just making people really nervous about the future of the country.

Meanwhile, we’ve got another round of trade restrictions from the US, and the Chinese are fighting back with some trade controls of their own – it’s enough to make you wonder if we’re headed back for a full-blown trade war, and the dollar is just not doing well as a safe-haven investment as a result.

USD/CHF Technicals Show That Channel is Struggling

On the charts, USD/CHF is pretty clearly in a descending channel on the 1-hour chart. But the pair is now running into trouble at around 0.7968 – that’s where the 20-period EMA and 50-period EMA are both giving it a hard time. And the fact that both those EMAs are pointing down is just telling you that the bears are in charge. Every time the price has tried to move up and get back into these zones, its been rejected – that’s just a sign of seller control.

The RSI has come back up a bit, it’s at 46 now, but there’s actually a bullish divergence between the price and RSI, and that’s starting to make some traders think maybe we’ll see a bit of short-term relief. But then you look at the candles on the chart and you see a few spinning tops and dojis, which basically means the traders are just kind of sitting on their hands right now, unsure of what to do next.

If the price can finally break above 0.7985 then we’re talking about the possibility of a rebound leg up to 0.8008 or 0.8046. But if it fails to hold above 0.7932 then we could see the price drop back down to 0.7909 or 0.7882.

USD/CHF Trade Setup: Waiting for that Clarity

For those traders who are just starting out, here’s a pretty straightforward trade idea:

- Entry: Go long once the price closes above 0.7985 for the day – that’s your confirmation

- Targets: 0.8008 first, then 0.8046 if the price momentum keeps going up

- Stop-loss: below 0.7930 just in case it all falls apart

This trade idea is based on a pretty simple “buy the break” strategy – you want to wait for confirmation before committing, because right now the price is really struggling to get out of this descending channel. If the price does manage to break out and move up, then the targets should give you a reasonable idea of where it’s going to end up – but until then, you’ve got to be a bit cautious.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM