Gold Price Prediction: $3,380 Triangle Signals Breakout as Fed Turmoil Looms

Gold is trading at $3,380 per ounce and holding steady as the dollar strengthens on US political turmoil...

Quick overview

- Gold is currently trading at $3,380 per ounce, benefiting from a stronger dollar amid US political uncertainty.

- The market is in a consolidation phase with a symmetrical triangle formation, indicating a potential breakout soon.

- Key resistance is at $3,394, while support is strong at $3,360; movements beyond these levels will dictate the next price direction.

- Traders should be cautious as the upcoming candle could significantly influence gold's trajectory for September.

Gold is trading at $3,380 per ounce and holding steady as the dollar strengthens on US political turmoil. Uncertainty around the Federal Reserve’s independence and President Donald Trump firing Governor Lisa Cook has spooked the currency markets but for gold that’s been a positive.

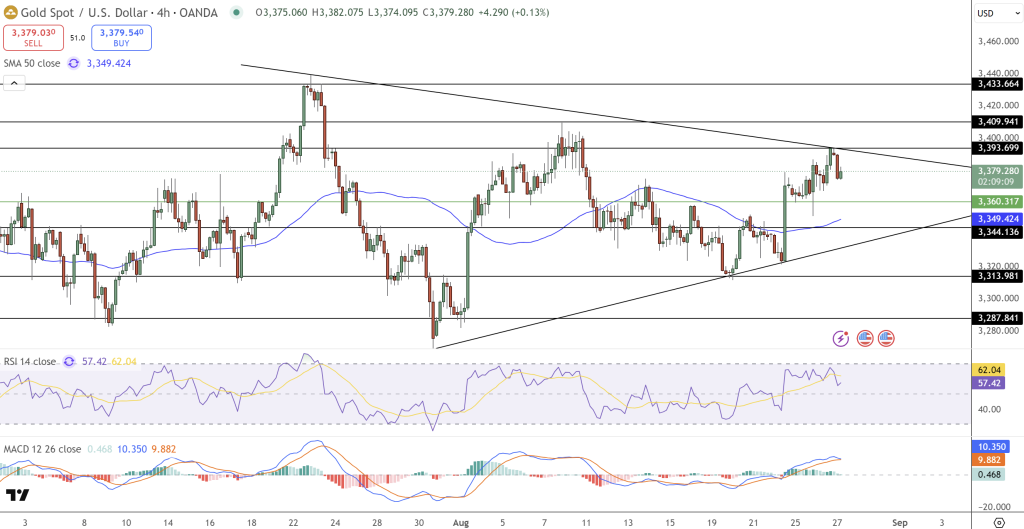

The metal is in a consolidation phase. Over the last few weeks a symmetrical triangle has formed on the charts, with buyers pushing up from $3,288 and sellers defending $3,440. This kind of compression usually precedes a breakout and gold is now pressing against the top of the triangle, so the stakes are high for the next move.

Gold Technical Setup Points to Breakout

On the 4-hour chart gold is bullish as long as it holds above $3,349. Candlestick action shows a recent rejection at $3,393 with a spinning top formation – a classic sign of indecision at resistance.

Momentum indicators add to the setup. The RSI at 58 has room before it becomes overbought and the MACD is converging on zero which could be a bullish crossover. Long lower shadows on recent candles show dip buyers are active and the pattern of higher lows is intact.

Key technical points:

- Upside breakout: Above $3,394 targets are $3,410 and $3,433.

- Support: $3,360 is near term strong; failure opens $3,344 and $3,314.

- Downside risk: Below $3,344 confirms weakness to $3,288.

This setup shows tightening control by the bulls but also the risk of sharp reversals if they don’t follow through.

Gold Price Prediction: Trade Setup

For traders the setup is clear: gold is about to resolve. Above $3,394 and it’s off to $3,433 which is the top of the triangle. Below $3,344 and it’s bearish and gold will head to $3,314 and $3,288.What’s important here is the timing.

With the dollar under pressure from political risk and the Fed’s independence in question gold’s safe haven status remains intact. If institutional buyers step in the symmetrical triangle could be less a sign of stalling and more the springboard for a big move up.

In my opinion the next candle is more important than the last. Gold’s consolidation won’t last much longer and whichever way it breaks will set the tone for September. For now the bias is bullish but traders should be prepared for big moves in either direction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account