We just pulled the trigger on NZD/USD; we sold this forex pair moments ago and I know this is a countertrend trade, but here we are, short NZD/USD.

Why would I go against the trend and sell NZD/USD you´d normally ask.

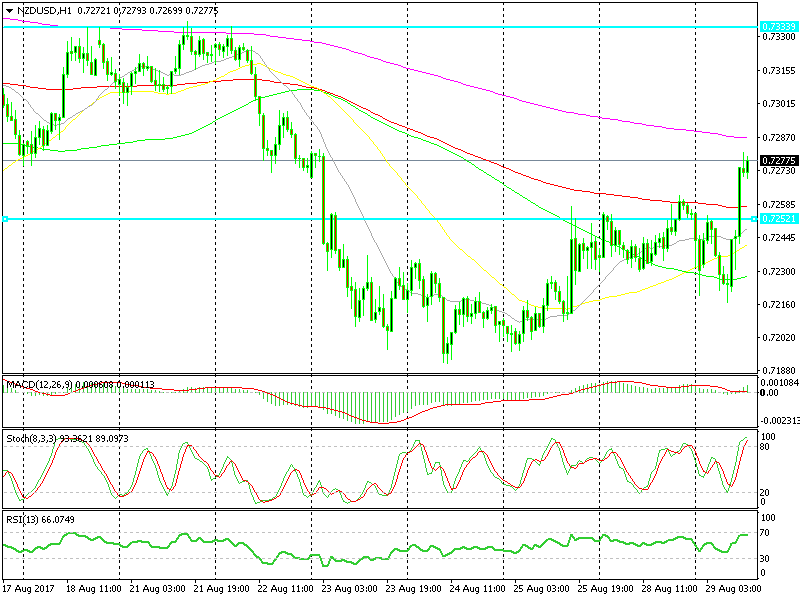

Technically, this pair is overbought on the H1 and H4 charts. The 60 pip climb this morning amid broad USD weakness has taken the technical indicators at overbought levels.

Besides that, there are quite a few moving averages standing above where the price is right now which are supposed to provide resistance, particularly the 200 SMA on the hourly forex chart and the 100 SMA on the H4 chart.

Today's trend is up but the bigger trend is down

Today's trend is up but the bigger trend is down

But that´s not the main reason for this signal; the main reason is the NZD failure to take advantage of the USD weakness and push higher. Instead, it is lower against the USD from last week, while the other currencies are all up against the Buck.

Even the Aussie has gained a fair amount of pips against the USD since the beginning of last week, while the NZD hasn’t. That´s a strong signal that this pair fancies the downside, so that´s why we took this signal.