Markets on Tuesday: What’s the RBA Got in Store for the AUD/USD?

It was a quiet start to the week as we might expect when our American friends are on holiday. Tuesday marks the start of what is a busy week on the central bank front.

Today we’ll get an update on from the RBA on what exactly they’re thinking in regards to monetary policy. For the most part, the Aussie economy has been lagging the US and rate hikes aren’t really front and center just yet. However, they are in the back of everyone’s mind.

So overall there will likely be anything new to add. And I suspect the Aussie will maintain its bearish trend, with the highs at 80 cents stopping us from moving any higher.

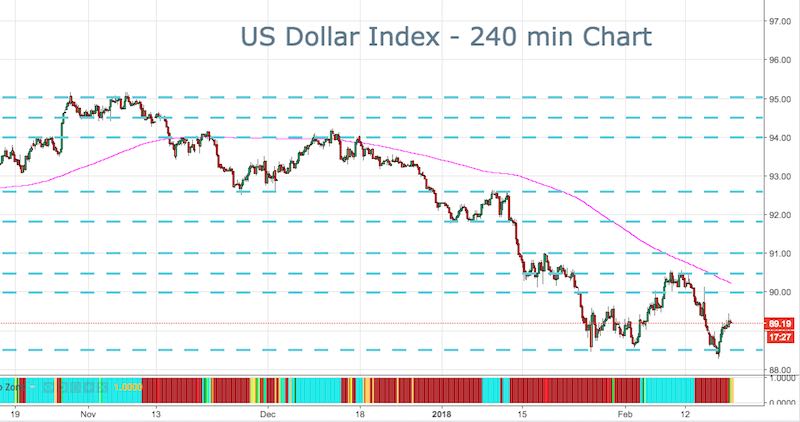

Triple Bottom in the USD

The USD has been weak over the most recent future and we might at the end of the bear run.

We have made somewhat of a triple bottom and it appears to be that momentum might be turning. There are a number of fundamental reasons the USD should be appreciating, but as yet its been predominantly downside.

89.50 seems to be holding for now, but the big test will be when we hear from the FOMC.

US Dollar Index (DXY)- 240 min Chart.