Mixed US Employment Report Leaves Traders Undecided

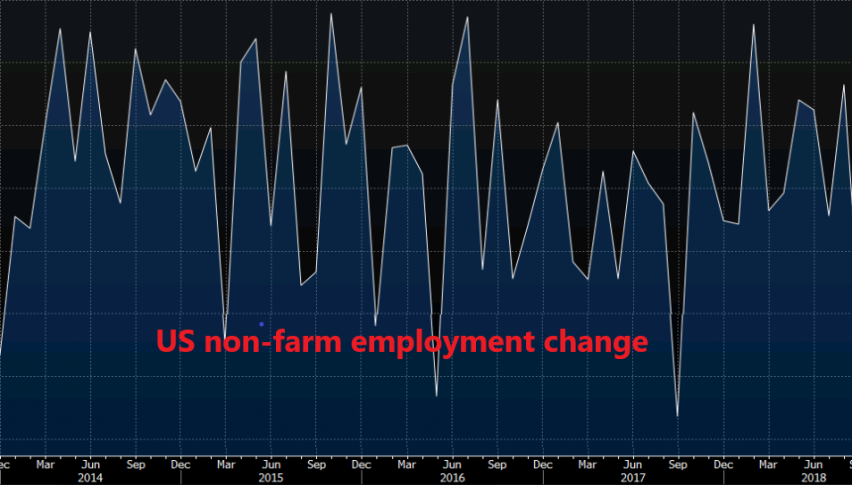

The round of economic data from the US is now out and it is a mixed bag overall. The unemployment rate ticked higher once again after increasing by two points last month, on the other hand, the non-farm employment change number was twice as big as the number that economists were expecting. Here are the sub-components of the employment report listed below:

| US Economic Data | Actual | Previous | Expected |

| Unemployment Rate | 4.0% | 3.9% | 3.9% |

| Participation Rate | 63.2% | 63.0% | 63.0% |

| Non-Farm Employment Change | 304k | 265k | 312k |

| Average Hourly Earnings MoM | 0.1% | 0.3% | 0.4% |

| Average Hourly Earnings YoY | 3.2% | 3.2% | 3.2% |

| Average Weekly Hours | 34.5 | 34.5 | 34.5 |

| U6 underemployment rate | 8.1% | 7.6% |

As you can see from the table above, the unemployment rate has returned to 4.0%. But, the participation rate has also increased by 2 points which means that more people are looking for work, hence the increase in the unemployment rate. This is the highest participation rate since 2014.

the pace of growth for the average hourly earnings declined to 0.1% in January from 0.4%in December. The underemployment also shot higher to 8.1%. On the other hand, the non-farm employment new jobs look pretty impressive once again after the surge we saw in December.

Overall, this is a mixed report and the USD traders seem confused now. The USD lost around 20 pips after the release but is back to unchanged now. The FED left it to the economic data to decide for the path of the monetary policy this year and this report doesn’t point to any direction.