Daily Brief, Mar 9: Gold Crosses $1,700 & Drops to $1,668 – What’s Next?

On the news front, the major focus will remain on the German trade balance data and the ongoing coronavirus tensions around the globe. Overall, the economic calendar is a bit light today. Therefore the technical levels will play in the market.

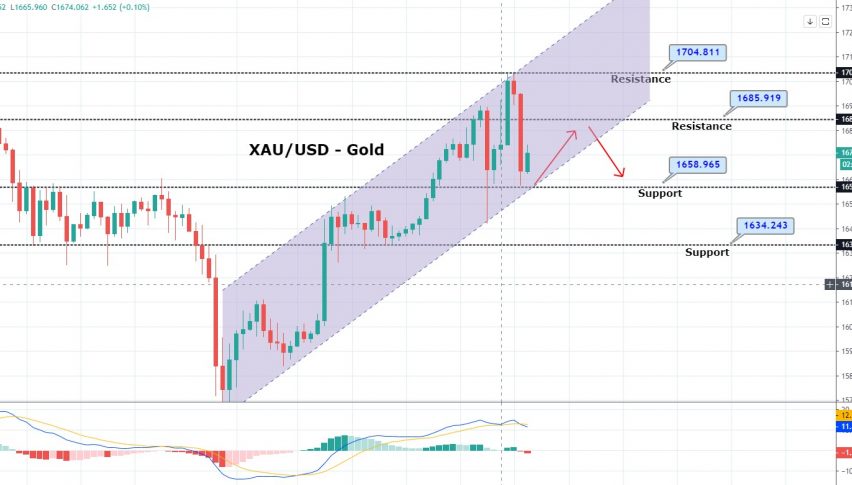

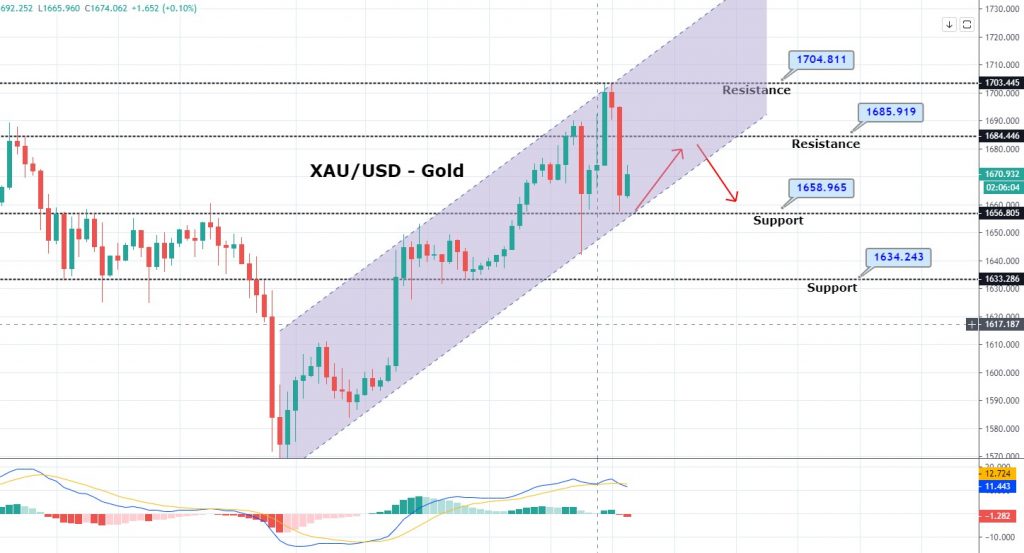

Today in the early Asian session, the safe haven metal prices failed to maintain its bullish trading above $1,700 per ounce level for the first time since late 2012 on Monday and dropped to $1,662.80, down 0.73%. As the press time, gold is currently trading at $1,670.01 and consolidates in the range between the 1,657.68 – 1,703.10.

Gold rose 1.5% to $1,699.20 per ounce by 0054 GMT, having touched its highest since December 2012 at $1,702.45 earlier in the session. However, the yellow metal’s early day bullish trend could be attributed to the risk-off market sentiment while the latest drops in gold prices came after knowing that the global policymakers’ willingness to counter the coronavirus (COVID-19). Gold prices jumped past $1,700 as an ongoing coronavirus outbreak and a fall in crude oil hammered equities and sent investors scurrying for safe havens.

It is worth mentioning that the total blockage in Lombardy and the increasing death losses in Italy, moreover the headlines from Saudi Arabia/Russia, are the reason behind the early-Asian market risk-off sentiment. As a result, the momentum boosted the yellow metal towards a multi-month top piercing $1,700, high of $1,703.40.

Additionally, the US ten-year treasury yields recovered from the record low of 0.477%, flashed during the early-day, to 0.528% by the press time. Further recovery could also be observed in Asian stocks that are returning from the initial loss of more than 4.0% to sub-3.0% in most cases.

As per latest updates, mainland China had 40 new confirmed cases of infections on Sunday, the National Health Commission said, taking the country’s total number of confirmed cases to 80,735. Looking forward, due to no major data on the UK’s economic calendar, traders will keep their eyes on the virus updates while investors will hardly move anywhere else to search for near-term direction.

Daily Support and Resistance

S1 1569.91

S2 1619.68

S3 1646.71

Pivot Point 1669.45

R1 1696.48

R2 1719.22

R3 1768.99

[[GOLD]] prices continue to trade sideways, bullish and bearish both in the wake of increased demand for safe-haven assets. It earlier touched 1,702 and now drops to 1,662 level. On the lower side, the precious metal may find support around 1,660 and 1,647, while resistance continues to stay at 1.670.

Good luck!