Daily Brief, Apr 24: Things You Should Know About Gold Today

Happy Friday, fellas.

Today in the early Asian session, the safe haven metal stopped its two consecutive days’ winning streak and dropped from the weekly high while taking rounds to $1,730, mainly due to the recovery in the pandemic figures which eventually provided modest gain to the risk sentiment. Meanwhile, the stability in the oil prices boosts investor sentiment, which keeps the risk sentiment calm on the day. GOLD futures are currently trading at 1,744.50 and consolidating in the range between 1,742.40 and 1,752.35. However, even though the safe haven gold earlier cheered the market’s risk-on sentiment, it has failed to hold gains recently due to multiple news.

The yellow metal futures rose during the previous session mainly because the US House of Representatives passed a $484 billion COVID-19 relief bill overnight, which will be the fourth bill to support the US economy from the COVID-19 pandemic storm.

The concerns about the failures of Gilead’s Remdesivir, and possible vaccine to the coronavirus (COVID-19), keep the risk tone directionless. Although, the possibility of BOJ discussing cutting bond purchase limits in its Monday meeting kept the risk aversion in check.

US diplomats are fueling the idea of restarting economic activity in states as soon as possible after witnessing recovery in the coronavirus cases. However, the White House Adviser Larry Kudlow and Secretary of State Mike Pompeo used the opportunity to state that China is responsible for the outbreak.

Moreover, the US House passed a $484 billion relief package for small businesses, hospitals and testing facilities, while the Federal Reserve also showed a willingness to ease the way for small businesses to fight against the epidemic. As a result, the S&P 500 futures remain on the backfoot, representing 0.43% decline on the day to 2,770, after the suspicious performance of Wall Street.

Looking forward, due to the lack of major data on the economic calendar ahead of the US session, traders will keep their eyes on the virus updates for taking fresh directions. During the day ahead, markets may extend the risk-on sentiment, which was caused by the aid package approval, if the scheduled Durable Goods Orders and Consumer Sentiment data beat economists’ expectations.

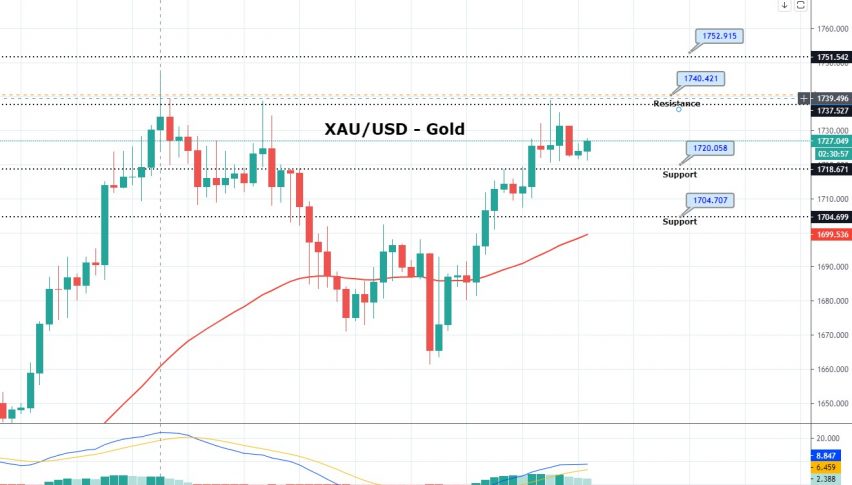

Daily Support and Resistance

S1 1627.06

S2 1665.81

S3 1690.01

Pivot Point 1704.56

R1 1728.76

R2 1743.31

R3 1782.06

Gold is facing triple top resistance at 1,737 level, and closing of candles below this level is suggesting chances of bearish retracement in the market. Currently, gold is finding support at 1,720. In case it breaks lower, next support is likely to be found at 1,708; however, the bullish bias remains solid. The leading indicators, such as RSI and Stochastic, are suggesting a bullish bias for gold. Thus, the breakout of 1,737 levels can trigger more buying in the yellow metal, and it may lead it towards 1,750.

Good luck!