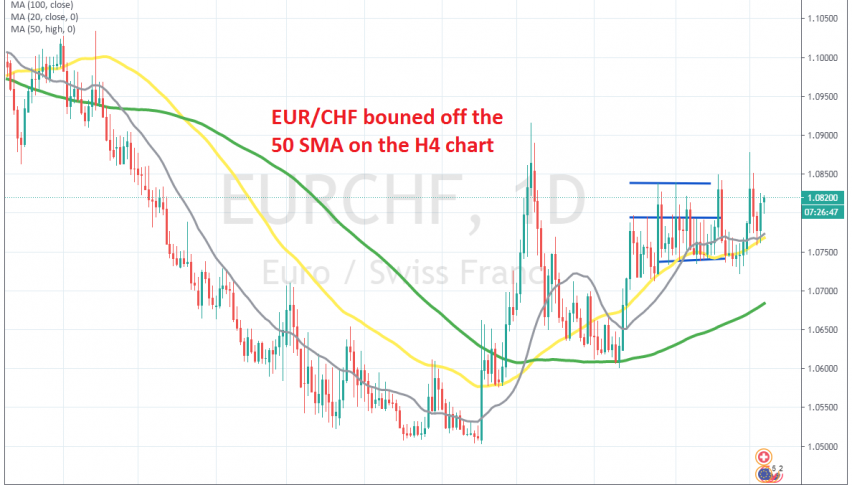

The 50 SMA Keeps EUR/CHF Supported, AS Safe Havens Lose Momentum

EUR/CHF turned bullish in may, after comments from EU leaders about the coronavirus recovery plan for the new generation. That improved the sentiment for the Euro, which turned quite bullish since then. EUR/CHF broke above all moving averages during the end of May and the beginning of June.

The price surged to 1.0915 from 105, which was the bottom the Swiss National Bank could afford. They intervened down there, helping in this bullish surge during that time. The price retreated back down to 106, but that’s where the 100 SMA stood on the daily chart, which turned into support for EUR/CHF.

The price bounced higher in the next few days, but then buyers lost some strength, although the bullish trend has been going for this pair. The 50 MA (yellow) has now turned into support for EUR/CHF and after the bounce and the reversal down last week, we saw another bullish reversal from the 50 SMA. Today, the bullish momentum is going, as safe havens turn bearish. So, the pressure remains to the upside for this pair and we will try to buy pullbacks lower tot he 50 SMA.