A Breakout in US 5-Year Bonds Might Spark Big Moves Elsewhere

The US 5-year notes have essentially been trading range-bound since March but we could be at the end of the period of consolidation. Yesterday’s rates were in danger of closing at the highest level of the year. We’re almost at the highs for the year as the chart below shows.

All moving averages were providing support on the daily chart in the recent months and in the last week, US bond yields bounced higher. The triangle is tightening and a breakout is expected soon. Jeffrey Gundlach which is known as the bond king, says that the breakout will take place to the upside. It might be true and if a breakout above 1% happens, then that would be a good time to buy US 5-year bonds.

This is such a classic chart. There’s the big breakdown, the retracement, the consolidation, then it’s broken higher. The delta scare in July caused a fake break to the downside but with the move up now, that simply confirms the rejection of the bottom of the range. Once this breaks to the upside, I think it’s a fairly straight shot to 1.35%, though I doubt it will be as fast as February/March.

How does that look in other markets?

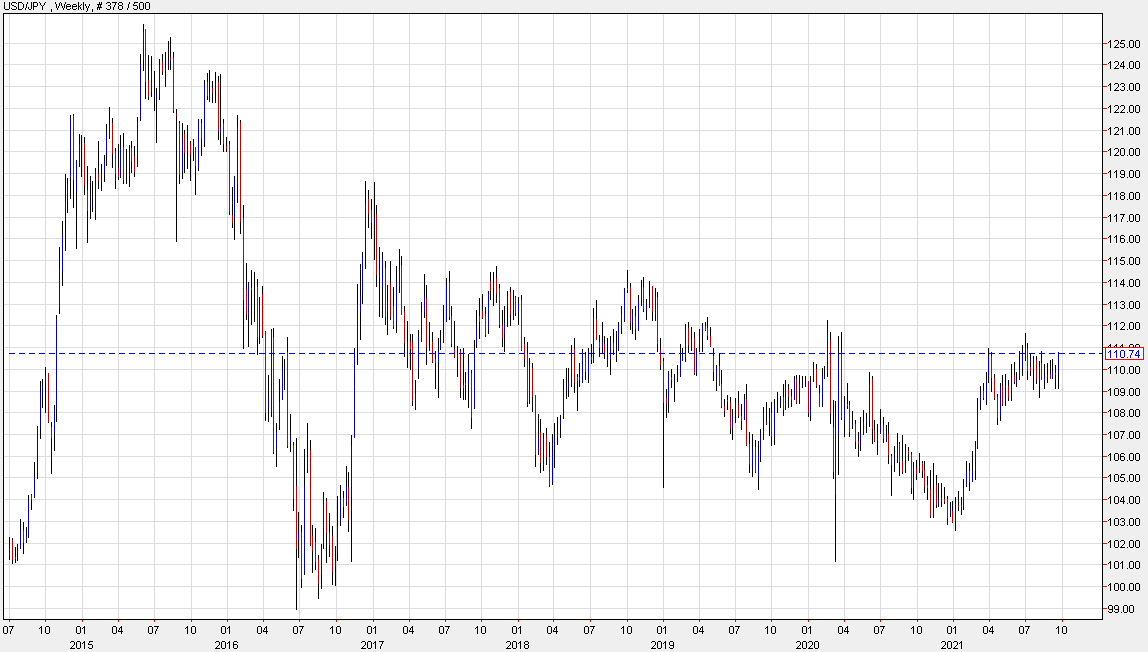

For sure it’s good in USD/JPY and that will track this very closely. You’ll note that this pair has been stuck in the mud since March as well — that’s not a coincidence. If/when this breaks to the upside, so will the yen. The first target would be something modest like 114.00 but if you’re bullish on the recovery you can make the case for 125.00.

The takeaway for me more broadly would be a reflation trade. I’ve highlighted the money flowing into the Russell 2000 ETF today and I think that’s telling as well. Tech would once again underperform in a world of rising rates.

I’m still worried about China but the market now believes they’re more likely to stimulate while simultaneously trying to deliver. I think the most-overlooked piece of news this week was buried in the WSJ story about the demise of Evergrande.

Policy makers are also considering gradually easing some property curbs in smaller Chinese cities, such as making ownership of a second home easier, according to one of the people. They could also moderate some of the stringent deleveraging measures on property developers that helped push heavily indebted Evergrande toward the precipice in recent months, this person said.

If China turns on the taps in any way, there’s plenty to like here but at this point, it might be better to wait for the news.