Euro Turns Lower, As ECB Puts Off Bullish Bets

The Euro had been showing some bullish pressure in the last few weeks and yesterday we saw a run higher ahead of the ECB monetary policy decision today. Markets had fully priced in a 50 bps rate hike in July, and a hawkish policy to follow. But, the European Central Bank (ECB) threw cold water on those expectations and the Euro has turned lower.

ECB Announces Monetary Policy Decision – 9 June 2022

- ECB leaves key rates unchanged in June monetary policy meeting, as expected

- Deposit facility rate -0.50%

- Main refinancing rate 0.00%

- Marginal lending facility 0.25%

- APP purchases to end on 1 July

- Intends to raise key interest rates by 25 bps at July meeting

- Looking further ahead, ECB expects to raise rates again in September

- Inflation pressures have broadened, intensified

- Will maintain optionality, data dependence, gradualism and flexibility

- Inflation seen at 6.8% in 2022, 3.5% in 2023, 2.1% in 2024

- GDP growth seen at 2.8% in 2022, 2.1% in 2023, 2.1% in 2024

- Full statement

The euro got a bit of a whipsaw with a push to 1.0748 before falling back down to 1.0688 and is now keeping around 1.0700 against the dollar. The key passage is that the ECB “intends” to hike rates by 25 bps in July but they are leaving the option for a potential 50 bps rate hike in September though. On the latter, the statement reads:

“Looking further ahead, the Governing Council expects to raise the key ECB interest rates again in September. The calibration of this rate increase will depend on the updated medium-term inflation outlook. If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting.”

That will come down to inflation data in the months ahead but for now, the euro is being knocked around a little as the hawkish bets (even if it were to be little to begin with) coming into the meeting are put off – for July at least. Besides that, the ECB raises its inflation forecasts and cuts its growth forecasts – which is very much expected.

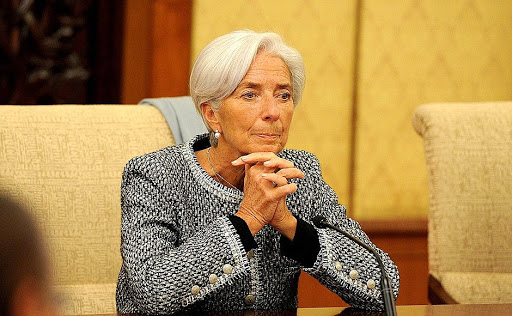

ECB’s Lagarde Statement

- Inflation pressures have broadened

- We will make sure inflation gets back to target over the medium term

- High inflation is a major challenge

- Conditions are in place for the economy to continue to grow

- “inflation pressures have intensified”

- “inflation will remain undesirably elevated for some time”

- Governing council will retain optionality

- Initial signs of inflation expectations above target warrant monitoring

- The war is a big downside risk to growth

- Wage growth has started to pick up

- War and pandemic in China has made supply bottlenecks worse

- Near term activity is to be dampened by high energy costs

- If demand were to deteriorate it would dampen prices

- Risks to inflation primarily tilted to the upside

- Prices rises are becoming more widespread

EUR/USD Live Chart