Ethereum Price Prediction: Fed Holds at 5.50%, Buterin Eyes Crypto-AI Synergy

During the Early European session, Ethereum is trading at $2,274.83 with a 24-hour trading volume of $11,195,139,833. Despite a 2.72%...

During the Early European session, Ethereum is trading at $2,274.83 with a 24-hour trading volume of $11,195,139,833. Despite a 2.72% decline in the last 24 hours, Ethereum remains the second-largest cryptocurrency, boasting a market cap of $273,394,736,886, supported by a circulating supply of 120,182,539 ETH coins. Let’s take a quick look at the fundamentals side of the market.

Vitalik Buterin on Blockchain-AI Integration

Ethereum co-founder Vitalik Buterin delves into the merger of blockchain technology and artificial intelligence (AI), outlining potential collaborations and cautionary advice. He identifies four key interaction areas, including AI’s participation in blockchain mechanisms and its role in enhancing user interface experiences for crypto applications.

Buterin emphasizes caution, particularly in using AI to govern blockchain systems and the speculative venture of blockchain-supported AI development. He underscores the juxtaposition of blockchain’s transparency with AI’s susceptibility to adversarial manipulation, urging careful navigation in high-stakes blockchain applications.

Buterin’s perspective highlights the innovative potential of combining these technologies. It underscores the critical importance of security and ethical considerations in their convergence, signalling potential impacts and opportunities for Ethereum in a steadily evolving tech landscape.

Fed and FOMC Hold Interest Rates at 5.50%

The US Federal Reserve’s decision to maintain interest rates at 5.25%-5.50% signals a cautious approach towards monetary policy adjustments. The Fed’s stance may influence the cryptocurrency market, including Ethereum, by opting to keep rates unchanged at their first 2024 meeting and hint at potential cuts no earlier than May.

This steady interest rate environment could stabilize investor sentiment, potentially fostering a more predictable landscape for Ethereum investments as the market navigates economic uncertainties.

Now, let’s take a quick look at the technical outlook of Ethereum.

Ethereum Price Prediction

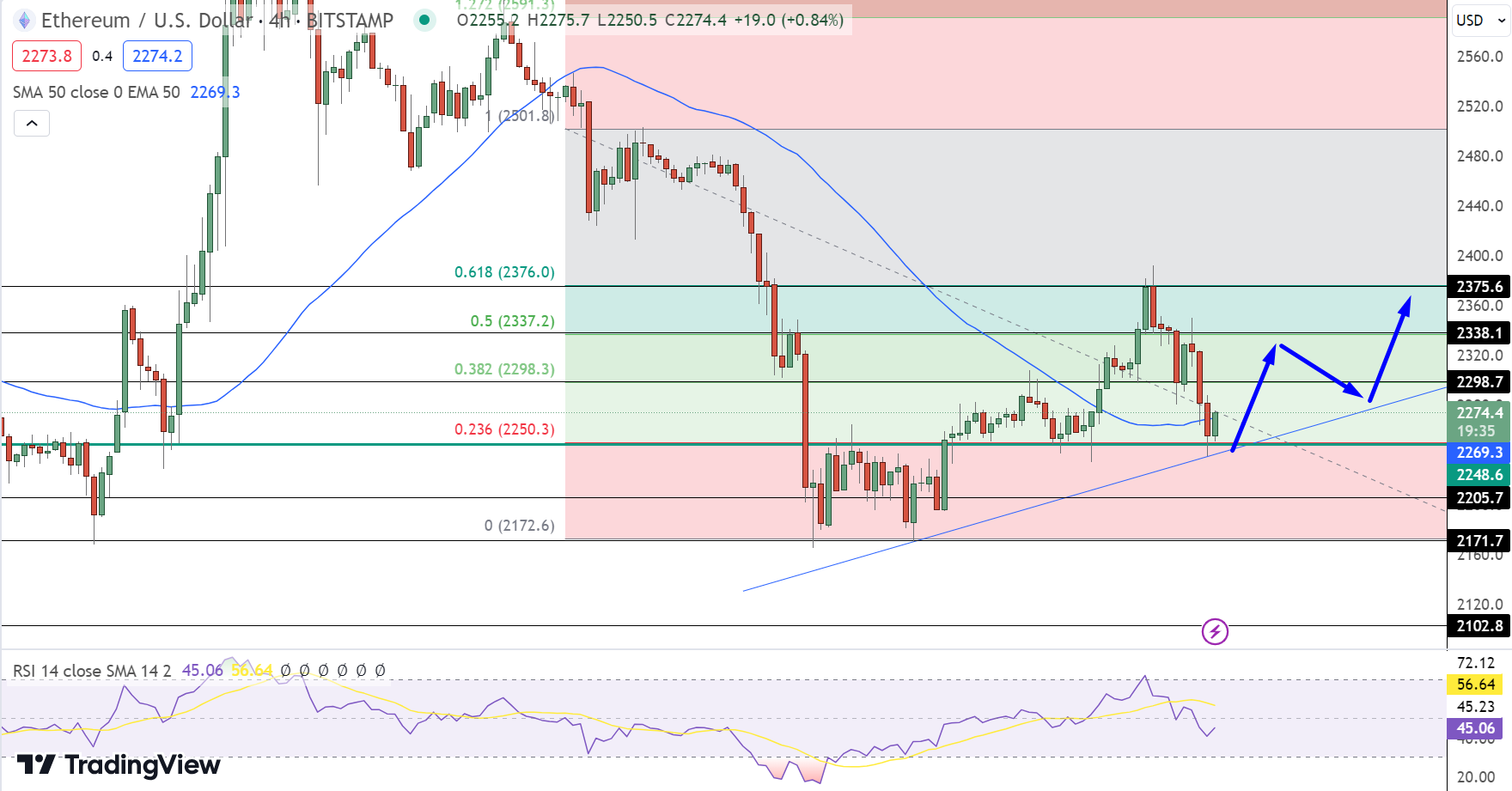

The ETH/USD’s pivot point, represented by the green line, is $2248.6. Immediate resistance levels are noted at $2298.7, $2338.1, and $2375.6, while support levels lie at $2205.7, $2171.7, and $2102.8.

Technical indicators reveal an RSI value of 45, suggesting a balanced sentiment. The MACD indicator’s precise values are awaited for a comprehensive assessment.

Ethereum’s chart pattern shows it is holding just above the 23.6% Fibonacci retracement level of approximately $2250.30, where an upward trendline offers support, favouring a bullish bias.

ETH/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account