Walt Disney Q1 2025 Earnings Preview: What to Expect

Walt Disney Q1 2024 Earnings Preview: What to Expect

The Walt Disney Co., an iconic global entertainment and media giant with roots dating back to 1923, is set to unveil its Q1 2024 earnings report on February 7th, 2024, after the market closes. The company operates through two core segments: Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences, and Products (DPEP). While DMED oversees the company’s worldwide film and television content production and distribution endeavors, DPEP encompasses its theme parks, experiences, and consumer products.

Revenue Insights and Performance Analysis

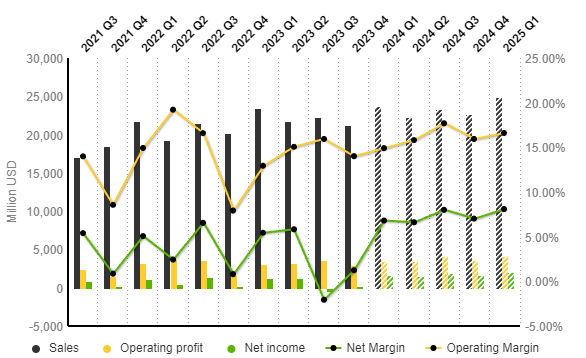

In Q4 2023, Walt Disney reported a revenue of $21.2 billion, reflecting a slight decrease of -4.88% from the previous quarter but a commendable increase of 5.41% compared to the same period the previous year. Notably, revenue from the Disney Parks segment surged by 13% year-over-year to $8.2 billion, propelled by robust attendance and guest spending growth in international parks, partially offset by lower results in domestic parks and resorts. Segment operating income also saw a significant uptick, rising by 31% year-over-year to $1.76 billion.

Conversely, the Media and Entertainment Distribution segment witnessed a more modest growth of 2% year-over-year in revenue, reaching $9.5 billion. While both domestic and international channels experienced losses, resulting in a 9% decline in Linear Networks revenue to $2.6 billion, the Direct-to-Consumer segment showed promise with a 12% year-over-year increase to $5.04 billion. Operating losses in this segment notably narrowed to -$0.42 billion, attributed to higher subscription revenue from platforms like Disney+ Core and Hulu, coupled with reduced costs in marketing, technology, and distribution.

Subscriber Growth and Market Performance

Disney+ subscribers globally showed improvement, reaching 150.2 million, marking a halt to the declining trend observed over three consecutive quarters. Notably, average monthly revenue per paid subscriber (ARPU) for domestic Disney+ increased by $0.19 to $7.50, while international Disney+ saw a $0.09 increase to $6.10. Management expressed optimism about future prospects, emphasizing key growth opportunities such as enhancing streaming business profitability and subscriber growth, bolstering ESPN as a digital sports platform, optimizing film studios’ output and economics, and driving growth in parks and experiences.

Market Projections and Technical Analysis

According to projections by S&P Global Market Intelligence, sales revenue for the upcoming quarter is anticipated to reach $23.8 billion, reflecting a 12% increase from the previous quarter and a 1.2% increase from the same period last year. Operating profit and net income are expected to show significant improvement, reaching $3.5 billion and $1.62 billion, respectively. Technical analysis indicates that Disney’s share price remains above its 52-week low, with strong support levels around $75.30. A bullish breakout above the dynamic resistance could potentially target levels around $105.60 and $126.40.

In conclusion, all eyes are on Walt Disney’s Q1 2024 earnings release, with stakeholders eagerly awaiting insights into revenue performance, subscriber growth, and future strategic initiatives in the ever-evolving landscape of entertainment and media.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account