FinecoBank Review

- Overview

- Minimum Deposit and Account Types

- How to Open a FinecoBank Forex Trading Account

- Products and Platforms

- Tailored Commissions

- FinecoX

- Trading Products

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about FinecoBank

- Employee Overview of Working for FinecoBank

- Pros and Cons

- In Conclusion

FinecoBank is a low-risk broker, earning a strong Trust Score of 92 out of 100. It is regulated by two Tier-1 authorities, the most trusted regulators in the industry, and has no Tier-2, Tier-3, or Tier-4 licenses, highlighting its high reliability and security for traders.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Overview

FinecoBank is a well-regulated Italian bank offering Forex trading services. With oversight from 🇮🇹 CONSOB and 🇬🇧 FCA, it provides a secure environment for traders. While its spreads average around 0.8 pips, they may be higher compared to some competitors. Nonetheless, FinecoBank’s robust regulatory framework and comprehensive trading platform make it a reliable choice for Forex traders.

Frequently Asked Questions

Is FinecoBank regulated for Forex trading?

Yes, FinecoBank is regulated by 🇮🇹 CONSOB and 🇬🇧 FCA, ensuring a secure trading environment for its clients.

What are FinecoBank’s Forex spreads?

FinecoBank offers Forex spreads averaging around 0.8 pips, which are competitive but may be higher than some other brokers.

Our Insights

FinecoBank provides a secure and regulated platform for Forex trading. While its spreads are slightly higher than some competitors, its strong regulatory oversight and comprehensive services make it a reliable choice for traders seeking a trustworthy broker.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Minimum Deposit and Account Types

FinecoBank’s Trading Account stands out as one of the most innovative offerings in Italy. With commissions starting from €2.95, zero management fees, and access to global assets, it provides traders with a secure and flexible solution backed by 🇮🇹 CONSOB oversight.

Frequently Asked Questions

What makes FinecoBank’s trading account different?

FinecoBank’s trading account combines professional-grade features with simplicity. Traders benefit from commissions starting at €2.95, zero monthly fees, and access to global markets. With support for Forex, CFDs, ETFs, and cryptocurrencies, it allows flexible strategies across multiple asset classes under strict regulatory oversight.

Does FinecoBank charge for ETFs or savings plans?

Over 800 ETFs can be purchased commission-free, making them attractive for cost-conscious investors. Savings plans, such as Replay, allow periodic investing with low fees starting at €2.95 per period. Fineco also offers promotional zero-cost ETF plans, helping traders and investors build portfolios efficiently.

Our Insights

FinecoBank delivers a transparent and innovative trading account suitable for both beginners and professionals. Although the lack of multicurrency activation is a drawback, its low commissions, advanced tools, and strong regulatory framework make it one of the most reliable and complete trading options available in Europe today.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

How to Open a FinecoBank Forex Trading Account

Opening a Forex trading account with FinecoBank is a straightforward online process. You can choose between a demo or live account, complete identity verification, and fund your account to start trading on FinecoBank’s platforms.

1. Step 1: Visit the FinecoBank Registration Page

Navigate to the FinecoBank website and click on “Open an Account” to begin your application.

2. Step 2: Complete the Online Form

Fill out your personal details, including your country of residence, phone number, email, and create a secure password. You will also need to complete a short trading experience questionnaire.

3. Step 3: Confirm Your Email

Check your inbox for a verification email from FinecoBank and click the activation link to access your client area.

4. Step 4: Submit KYC Documents

Upgrade to a live account and upload a valid government-issued ID and proof of residence to complete identity verification.

5. Step 5: Fund Your Account and Choose a Platform

Go to the “Money Management” section, select a deposit method from various options, fund your account (FinecoBank has no minimum deposit requirement), and choose between FinecoX, PowerDesk, or the Fineco App to start trading.

This entire process can be completed online, and while registration is quick, KYC review times may vary.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Products and Platforms

FinecoBank claims its crown as the No. 1 trading platform in Italy by total volume traded, a distinction validated by the AMF Italia Report for 1H 2025. Traders value its seamless tools, intuitive onboarding, and transparent pricing starting from €2.95 per trade.

| Feature | Details |

| Regulation Stability | Solid CET1 > 25 %, Strong Liquidity |

| Minimum Commission | From €2.95 per trade |

| Monthly Fee | € 0 for Trading Account |

| Product Range | Stocks ETFs CFDs Crypto Futures Options |

Frequently Asked Questions

What distinguishes FinecoBank’s trading account?

FinecoBank positions itself as Italy’s top trading platform. It offers no monthly fees, low commission from €2.95, selfie-based onboarding, and access to a vast product range – from stocks and ETFs to CFDs, cryptos, and beyond—backed by strong capital reserves.

How does FinecoBank handle financial stability?

FinecoBank maintains solid financial health, with a CET1 ratio above 25 %, a leverage ratio over 5 %, and excellent liquidity metrics such as LCR at 909 %, ensuring resilience amid market swings.

Our Insights

FinecoBank delivers an industry-leading trading experience with its strong capital base, broad product lineup, and user-friendly design. While the depth of platforms may challenge novice users, its innovation, financial strength, and regulator-backed trust make it a standout choice in the European trading space.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Tailored Commissions

FinecoBank offers a dual-account structure where commissions adapt to client needs. The Fineco Account rewards frequent trading with lower fees, while the Trading Account is ideal for smaller orders with a simple percentage fee. Both accounts provide flexible pricing and transparent cost structures.

| Account Type | Commission Model | Minimum Fee | Maximum Fee |

| Fineco Account | Volume-based discounts | From €2.95 per order | Varies by volume |

| Trading Account | 0.19 % of order value | Min. €2.95 | Max. €19 (stocks) |

| Futures/Options | Per lot pricing, tiered by asset | From €0.85 per lot | Up to $3.95 |

| Under-30 Clients | Fixed low pricing on stocks/ETFs | €2.95 / $3.95 | Zero on ETFs plans |

Frequently Asked Questions

How do commissions differ between the Fineco Account and the Trading Account?

The Fineco Account applies decreasing commissions based on trading volume, rewarding frequent traders. In contrast, the Trading Account charges a flat 0.19 % of the order value, with minimum and maximum caps, making it suitable for those placing smaller trades.

Are there special conditions for younger investors?

Yes, FinecoBank offers under-30 traders reduced fees. Italian stocks cost €2.95 per order, US stocks are $3.95 per order, and ETF savings plans can be set up at zero cost. This initiative supports younger clients in building long-term investment habits affordably.

Our Insights

FinecoBank provides traders with flexible commission models designed to match their trading style. With cost reductions for frequent traders, low entry costs for smaller orders, and special pricing for younger investors, Fineco’s commission system stands out as both transparent and adaptive.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

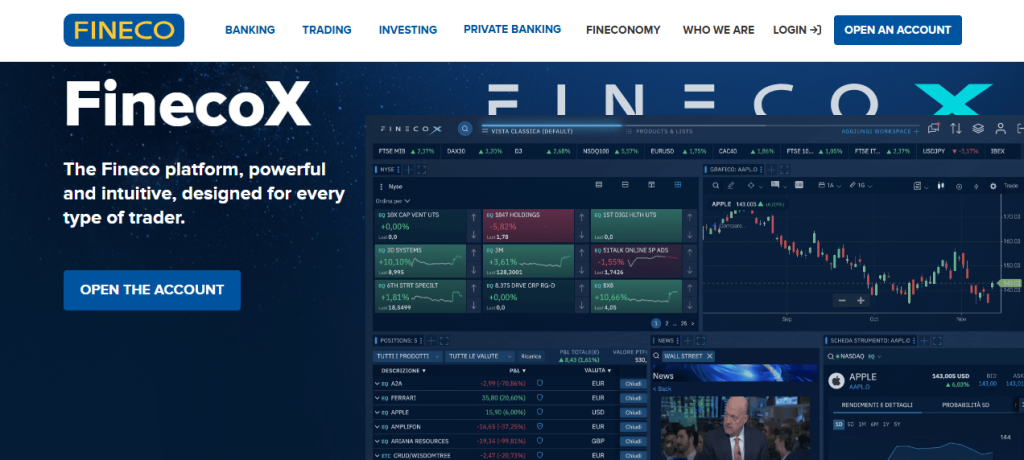

FinecoX

FinecoX is FinecoBank’s in-house platform, built to provide a professional yet accessible trading experience. Combining advanced tools with a clean, customizable interface, it caters to both beginners and experienced traders. FinecoX stands out for its zero management costs, flexibility, and seamless accessibility across devices.

| Feature | Details | Cost Structure | Accessibility |

| User Interface | Intuitive customizable drag-and-drop | Included in account | Desktop tablet |

| Trading Costs | Zero commissions on selected assets | Spread-only on CFDs | No hidden fees |

| Advanced Multibook | Up to 9x5 levels or 6x10 levels | Included in platform | Pop-up mode available |

| Market Tools | Global search watchlists alerts P/L view | Free with account | Real-time updates |

| News Ideas | Personalized news feed and trading ideas | Included in platform | Syncs across devices |

Frequently Asked Questions

What makes FinecoX different from other platforms?

FinecoX is designed in-house by FinecoBank experts, combining professional-grade trading tools with an intuitive interface. It offers features like fast one-click orders, advanced multibook views, synchronized watchlists, and zero-commission promotions on selected ETFs, certificates, and CFDs.

Can FinecoX be used without installation?

Yes, FinecoX is browser-based and fully accessible across desktop and tablet devices without requiring downloads. Traders benefit from synchronized layouts, real-time alerts, and customizable modules, ensuring a smooth experience across all supported platforms.

Our Insights

FinecoX delivers a feature-rich trading experience without extra costs. From advanced order execution and multibook depth to personalized layouts and zero-commission opportunities, it offers traders full control with flexibility. Its strength lies in combining professional functionality with simplicity and transparency.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

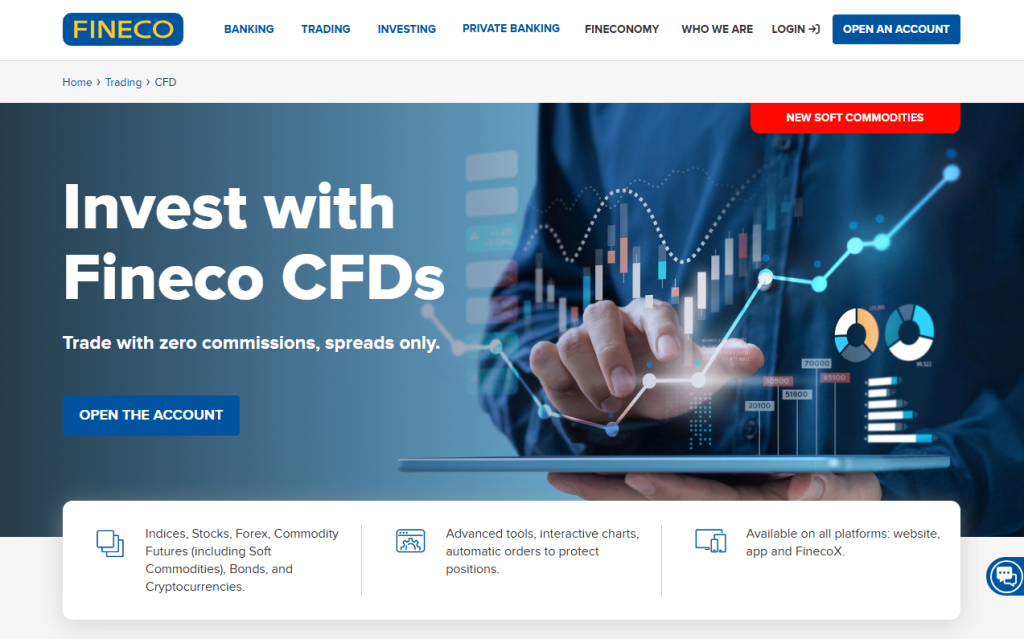

Trading Products

FinecoBank delivers a broad selection of tradable instruments, blending Forex options with other multi-asset markets. Whether traders seek CFDs, stocks, or complex derivatives, Fineco provides tools and access designed to meet diverse trading needs.

| Product Type | Details | Access Level | Features |

| Forex CFDs | Available with transparent spreads | Retail Professional | Up to 100:1 leverage for Pro |

| Equities ETFs | Stocks and ETFs across global markets | Retail | Wide range including zero-commission offers |

| Derivatives | Futures Options Certificates Covered Warrants | Retail | Broad multi-asset exposure |

| Bonds Covered Warrants | Government and structured bond products | Retail Professional | OTC and listed access |

Frequently Asked Questions

What types of Forex products can traders access through FinecoBank?

FinecoBank offers Forex CFDs alongside multiple asset classes like equities, bonds, ETFs, futures, options, certificates, and covered warrants. Traders benefit from transparent spreads and comprehensive market access.

Are there leverage options for Forex and CFD trading?

Yes, Professional clients can access up to 100:1 leverage on Forex CFDs and other CFDs. This high leverage is not available to retail clients under current regulations.

Our Insights

FinecoBank provides a robust multi-asset trading suite that includes Forex, especially Forex CFDs, alongside stocks, ETFs, bonds, futures, and more. With advanced platforms and competitive tools, it serves experienced and professional traders well, though high retail leverage remains restricted.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Customer Support

FinecoBank provides extensive customer service options, ensuring that clients and prospects receive fast and reliable support. With digital help, call centers, and in-person services, Fineco connects traders and banking customers with professional assistance at multiple levels.

Frequently Asked Questions

How can I open a Fineco account?

Opening a Fineco account can be done online or with help from a Fineco specialist. Customers can start the process digitally, and once approved, gain access to Fineco’s trading, current account, and investment services with transparent costs and clear onboarding steps.

What support is available for Fineco clients?

Clients have multiple ways to get help, including phone, text, and email. They can also log in to their account’s Support section for personalized assistance. Additionally, Fineco offers in-person support across Italy with Fineco Centers and financial advisors.

Our Insights

FinecoBank excels in customer support, offering both digital convenience and strong local presence. Its large network of financial advisors and service centers ensures customers can resolve issues quickly, whether they prefer in-person or remote assistance.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Customer Reviews and Trust Scores

FinecoBank has received mixed reviews from customers. While some users appreciate its trading platform, others have expressed concerns about customer service and account closure processes.

| Platform | Rating (5) | Highlights |

| Trustpilot UK | 1.0 | Slow account closures, poor service |

| Trustpilot ITA | 4.0 | Generally positive feedback |

| ForexPeaceArmy | N/A | Concerns about software reliability |

Customer experiences vary, with some praising the platform’s features and others highlighting areas for improvement.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Discussions and Forums about FinecoBank

Online forums and discussions reveal that traders have diverse opinions about FinecoBank’s services. Some users find the platform suitable for their needs, while others have encountered challenges.

| Forum | Discussion Summary |

| Trade2Win | Questions about account setup and funding |

| Mixed experiences with trading features |

|

| RebateKingFX | Dedicated thread for FinecoBank-related queries |

Engaging in these forums can provide potential users with a broader perspective on FinecoBank’s offerings.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Employee Overview of Working for FinecoBank

Employee reviews suggest that FinecoBank offers a supportive work environment, though experiences may vary across different roles and locations.

| Source | Rating | Key Takeaways |

| Glassdoor | 4.4/5 | Positive work-life balance |

| Indeed | N/A | Mixed reviews on pay and benefits |

| Fineco Careers | N/A | Opportunities for personal development |

Overall, FinecoBank appears to be a reputable employer, with many employees recommending it to others.

★★★★ | Minimum Deposit: $0 Regulated by: CONSOB, FCA Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by CONSOB and FCA | Limited customer support hours |

| Offers a range of trading tools | Mixed user reviews |

| Provides mobile trading apps | Account closure process delays |

| Transparent fee structure | Limited research tools |

| Strong regulatory oversight | Platform may be complex for beginners |

References:

In Conclusion

FinecoBank offers local offices and customer support in several countries, providing Forex traders with accessible assistance and services. While the bank has a strong presence in Italy, it also extends its services to other European countries, ensuring that clients have support tailored to their local needs. Countries with FinecoBank Local Offices and Customer Support include:

- 🇮🇹 Italy

- 🇬🇧 United Kingdom

- 🇩🇪 Germany

- 🇵🇹 Portugal

- 🇪🇸 Spain

- 🇫🇷 France

- 🇮🇪 Ireland

- 🇵🇱 Poland

- 🇳🇱 Netherlands

- 🇸🇪 Sweden

- 🇳🇴 Norway

- 🇩🇰 Denmark

- 🇫🇮 Finland

- 🇸🇰 Slovakia

- 🇨🇿 Czech Republic

- 🇭🇺 Hungary

- 🇷🇴 Romania

- 🇧🇬 Bulgaria

- 🇭🇷 Croatia

- 🇸🇮 Slovenia

- 🇬🇷 Greece

- 🇦🇹 Austria

- 🇨🇭 Switzerland

- 🇦🇺 Australia

- 🇺🇸 United States

FinecoBank’s extensive network ensures that Forex traders in these countries have access to local support and services, enhancing their trading experience. Whether you’re in Italy or abroad, FinecoBank strives to provide accessible and reliable assistance to its clients.

Faq

The broker offers competitive commissions and spreads, particularly to aggressive traders and those concentrating on large markets.

The broker normally processes withdrawals between 1 and 5 days, depending on the withdrawal method and the destination bank’s processing periods.

The broker offers a multi-currency account that combines banking, trading, and investment services.

The broker’s minimum deposit requirement is $0.

Yes, they provide a well-rated mobile app for iOS and Android smartphones. It enables you to trade, manage your portfolio, and access banking services while on the road.

- Overview

- Minimum Deposit and Account Types

- How to Open a FinecoBank Forex Trading Account

- Products and Platforms

- Tailored Commissions

- FinecoX

- Trading Products

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about FinecoBank

- Employee Overview of Working for FinecoBank

- Pros and Cons

- In Conclusion