Gold Below 50% Retracement Level – Is It Time To Sell?

The yellow metal Gold is losing its shine due to a combination of a stronger dollar, rising investments on the equity side, as well as an increased return on global bonds.

As we discussed in our Forex Signals Brief for May 10th, most of the bearish momentum was supported by the U.S. dollar as it gained popularity after Kansas City Fed President George's hawkish remarks. In his remarks, he played down the recent slowdown in the gross domestic product while saying that the central bank needs to gradually raise its short-term rates.

Additionally, there was a boost in safe-haven appeal after Donald Trump unexpectedly fired the FBI Director, James Comey.

Luckily, we managed to remain one step ahead. We had predicted the price action in the Gold in our earlier update Green Pips In The Gold – A New Trade Setup Ahead. This forex trading signal has not only hit our take profit but also remained in line with our prediction of a buying entry at $1214.

Forex Trading Signal

Investors are recommended to have a sell entry below $1225 with a stop loss above $1229 and a take profit at $1219.

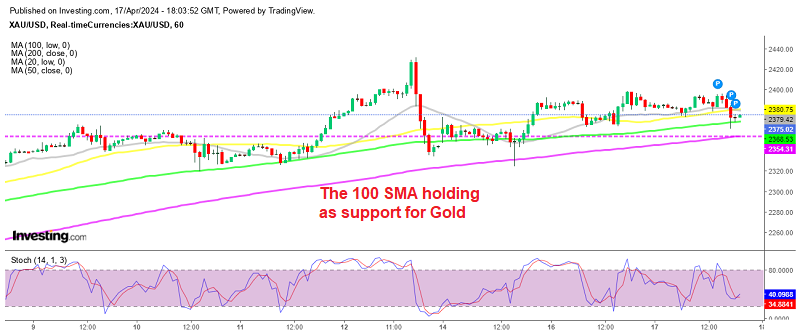

Gold – 4 Hours Chart

Technical Outlook – Intraday

The Gold has recovered from its earlier losses and has made its way upside towards the 50% Fibonacci retracement at $1225 in the 1- hour timeframe.

At the moment, the 50 periods EMA is extending a strong resistance at $1224/25. That's another bearish signal for us. But the momentum indicator RSI, which has just crossed over towards the buying zone, is presenting a problem.

If the break is above $1225 it is likely to extend bullish rally towards $1228 & $1232. Stay tuned for more forex trading signals!