Forex Signals Brief for Mar 23: Risk-off Sentiment In Play as Trade War Returns

It might be another day for safe-haven assets as the trade war concerns just got real. As you already know, US President Trump signed a memorandum to impose tariffs on $60 billion worth of Chinese imports. Consequently, the bullion market is on a bullish move while pushing the indices downward.

Thursday was a light day for the FX Leaders team. We ended with one winner and two losers. The sudden weakness in the Dollar helped us, closing out our GBP/USD trade. On the other hand, Trump & safe haven demand played against our USD/JPY signal.

Our long-term Bitcoin position is progressively moving towards take profit. We are also currently in our GBP/USD long-term short position, which is performing well.

This week remained highly volatile after the FOMC, Fed rate decision and Trump’s import tariffs. Today, we have more top-tier news from Canadian economy. So be ready with the forex signals page for all the latest updates. Our economic events outlook is releasing shortly.

Forex Signal Watchlist

Gold – Gold bullish trend looks unstoppable due to trade war fears. Sooner or later it’s going to enter the overbought zone and that’s where we will pocket some cash.

WTI Crude Oil – Despite all the efforts by OPEC and non-OPEC member countries, the Crude Oil output is high. We will be looking to enter a sell on an appropriate level.

Live Forex Signals

Bitcoin – G20 Summit

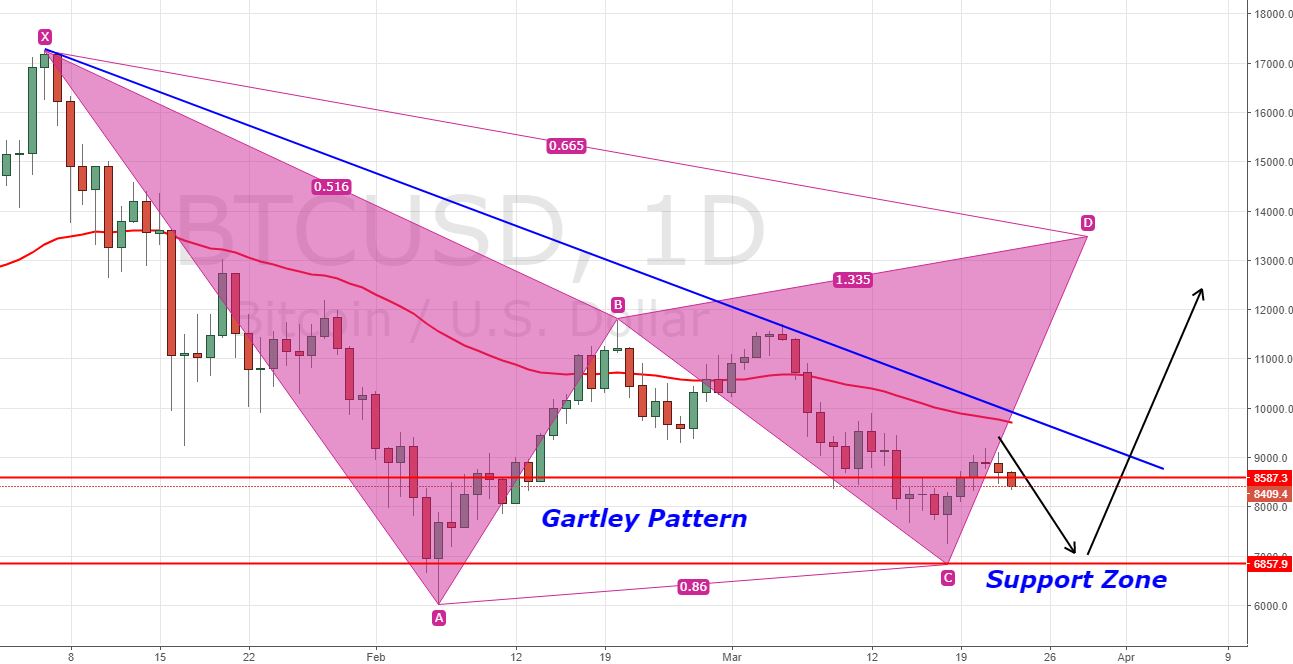

There has been a lot of discussions on Cryptocurrencies and their regulation, but with no clear decisions. Our long-term signal is holding at breakeven and the Gartley pattern is likely to support the bullish trend. Our profit target is at 11,640.

BTC/USD – Daily Chart

GBP/USD – Double Top Resistance Ahead

Our signal is trading near the breakeven due to weakness in the USD, especially amidst trade war fears. Consequently, investors have moved into other stable currencies such as Euro, JPY, and Sterling. Technically, the GBP/USD is facing a massive resistance at 1.4292 and it’s good enough to consider a bearish reversal.

GBP/USD – Daily Chart