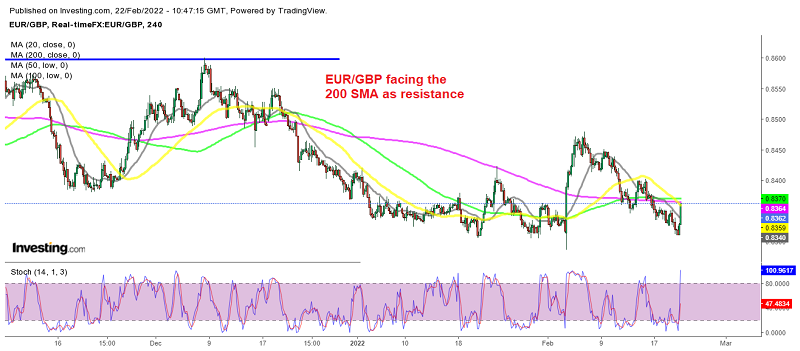

Mergers & Acquisitions Worldwide Decline to Lowest Levels in Three Years

According to data released by Refinitiv, mergers and acquisitions around the world fell by 16% YoY to $729 billion during Q3 2019 on account of intensifying trade tensions. This is the lowest quarterly volume of M&As seen in three years as rising economic uncertainties kept many companies away from making new deals.

The US-China trade war alone is responsible for driving considerable weakness in global economic growth over the past few months. Although the US economy remains supported by strong consumer spending, M&A activities in the US declined by 40% to $246 billion – the lowest performance since 2014.

The ongoing protests in Hong Kong, one of Asia’s most important financial hubs, have caused M&A activity to fall by 20% to $160 billion. On the positive side, however, M&A activity in Europe has seen an uptick of 45% YoY to $249 billion during the third quarter of this year.

With economic weakness weighing on economies both developed and emerging, businesses have also adopted a risk-averse attitude towards new business deals. A mismatch between buyers and sellers over expected valuation has been one of the key drivers driving down M&A volumes.