Faster PEPP Buying Temporary for the ECB, As Industrial Production Turns Positive in Europe

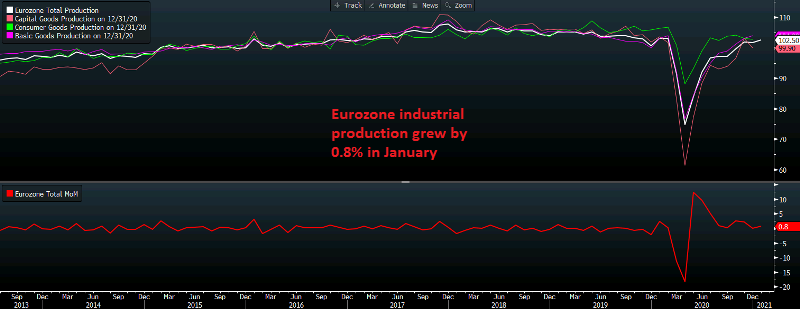

The industrial production has been volatile in Europe for several years now and after the jump in October and November, the production turned negative in December, declining by 1.6%. Although that was revised much higher to -0.1% today, while today’s report showed a 0.8% increase for january, beating expectations.

Eurozone January Industrial Production

- January industrial production MoM +0.8% vs +0.5% expected

- December production -1.6%; revised to -0.1%

- Industrial production WDA YoY +0.1% vs -1.9% expected

- Prior -0.8%; revised to -0.2%

Euro area industrial output was much stronger than estimated to start the year, with a positive revision to boost in December as well. The higher output was across all categories with durable consumer goods seen contributing the most, rising 0.8% on the month.

Remarks by ECB Policymaker, Madis Muller

- Faster pace of PEPP buying is temporary

- Planned total size of PEPP “will remain the same”

- Don’t overestimate yields impact on the recovery

If he’s trying to send a strong message, saying that the total PEPP envelope will stay the same, it isn’t really all too convincing. Nonetheless, with plenty of ambiguity as to how much, the ECB will pursue quicker and more purchases, they will have more to do in the months ahead in order to pacify the market – as evident already today.