USD/INR Bullish – US Dollar’s Strength, India’s Rising COVID-19 Tally Support

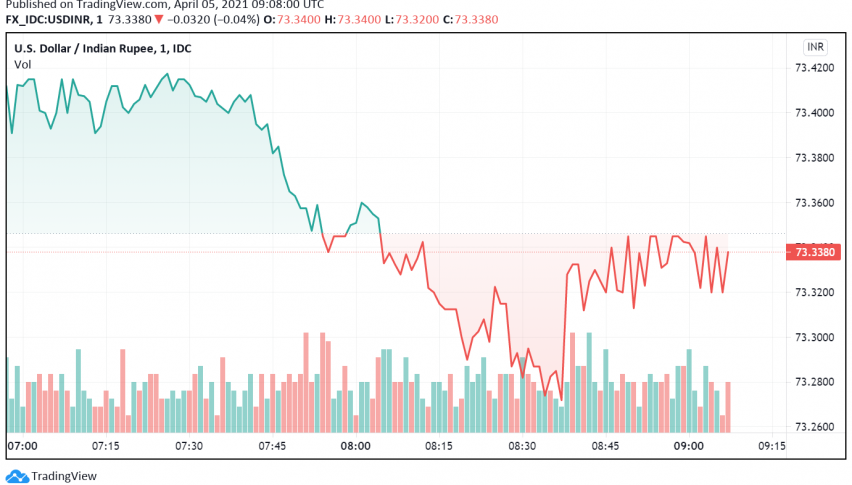

Early on Monday, the USD/INR currency pair is trading bullish, buoyed by a strengthening in the US dollar on account of a stronger than expected employment report even as India reports a record high increase in daily COVID-19 cases. At the time of writing, USD/INR is trading around 73.33.

The US dollar has been strengthening against most leading currencies worldwide over rising hopes that the US economy could post a faster than expected recovery from the coronavirus crisis. The possibility of rapid recovery was further bolstered after the latest NFP report which released last Friday revealed an addition of over 900k jobs to the economy during March, far higher than the 650k increase forecast by economists.

Meanwhile, the rupee is facing considerable downward pressure after India’s Health Ministry reported the highest daily spike in cases, more than 100k, on Monday, taking the total caseload of the emerging economy to more than 12.5 million. Health officials have cautioned that the second wave of the pandemic currently underway in India is far more deadly, which raises concerns that it could result in the imposition of fresh lockdowns and restrictions.

The outlook for the USD/INR is expected to remain bullish in the coming sessions with analysts forecasting the possibility of further gains in the US dollar even as the Indian rupee could experience more downside risks due to the second wave of the pandemic. After clocking a strong performance among Asian currencies through Q1 2021, the INR is likely to experience a period of weakness with its value depreciating to as low as 76.50 against the US dollar over the coming months.